escortbayan.online

Gainers & Losers

How To Open A Cash App Account

:max_bytes(150000):strip_icc()/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

Sign in to your Cash App account. View transaction history, manage your account, and send payments. The easiest way to unlock your cash app account is to contact Cash App support directly. Use the in-app chat feature to message support instantly. Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. Cash App offers peer-to-peer transactions, direct deposits, a savings account, a debit card, investing in stocks and Bitcoin, a tax filing service, and personal. A $Cashtag is the username for a person, business, or nonprofit on Cash App. You get to choose yours when you create an account. Find out more. How much does. You'll need to be a U.S. resident and at least 18 years old. If you want to use your account balance to send money to another Cash App user, then you'll need to. How To Sign Up · Download Cash App to your smartphone. · If this is your first time using the app, you will be required to enter a phone number or email login ID. Open Cash App; Click the “Cash Card” tab; Click “Get Cash Card”; Click “Continue”; Follow the remaining steps. And finito. There are no balance minimums or activity requirements. It doesn't cost extra to bank with Cash App. Cash App is a financial services platform, not a bank. Sign in to your Cash App account. View transaction history, manage your account, and send payments. The easiest way to unlock your cash app account is to contact Cash App support directly. Use the in-app chat feature to message support instantly. Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. Cash App offers peer-to-peer transactions, direct deposits, a savings account, a debit card, investing in stocks and Bitcoin, a tax filing service, and personal. A $Cashtag is the username for a person, business, or nonprofit on Cash App. You get to choose yours when you create an account. Find out more. How much does. You'll need to be a U.S. resident and at least 18 years old. If you want to use your account balance to send money to another Cash App user, then you'll need to. How To Sign Up · Download Cash App to your smartphone. · If this is your first time using the app, you will be required to enter a phone number or email login ID. Open Cash App; Click the “Cash Card” tab; Click “Get Cash Card”; Click “Continue”; Follow the remaining steps. And finito. There are no balance minimums or activity requirements. It doesn't cost extra to bank with Cash App. Cash App is a financial services platform, not a bank.

Register on Cash App without phone number by using a temporary number, a friend/family member's number with consent, or your Google account, balancing privacy. Open your Cash App, and go to the “Banking” tab where you find your balance. · Select “Linked Banks,” then follow prompts to replace or add your CARD account to. SSN Number and mailing address to verify the account. • Then request Cash App support to open the account. Send your request and clarify your position. The Cash. Wise Accounts are free to open, and you may save money when sending money to friends and family in over 80 countries, including the UK. Get a Wise Account today. Accessing Your Account · Select the profile icon on your Cash App home screen · Locate and select Sign Out · Then enter the phone number or email associated with. How To Use Cash App You must download the app on the Google Play Store and Apple Store to use Cash App. You need to set up your account, and you can link the. However, Cash App for Business is currently only available for individuals, or sole proprietors. At this time, there wouldn't be another option. Hey, There are two ways to sign up for Cash App: use the iOS or Android app, or make an account from the website. · Step 1: Enter your email. Cash App Visa prepaid debit cards issued by Sutton Bank. Show more posts from cashapp. Related accounts To find a store near you: open Cash App and go to the. Wise Accounts are free to open, and you may save money when sending money to friends and family in over 80 countries, including the UK. Get a Wise Account today. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. 1. Link a new debit card or bank account · 2. Tap the account balance on your Cash App home screen · 3. Tap Cash Out · 4. Select a Cash-Out speed. Try to use the account for a while and get paid and pay people and see if they will let you verify then. Launch the app: Once you have downloaded the app, open it on your mobile device. · Create an account: On the Cash App login screen, tap on "Sign. Cash App is an online money transfer app. A Cash App user can deposit money into their account using another bank account. You can access your account on. Go to the Card tab on your Cash App home screen; Select Get your free card; Select Continue; Follow the steps. You must be 13+ (with parental approval) or older. Download the Cash App · In your Cash App, create an account with your phone number or email address · Enter your MAJORITY debit card details, along with your name. Anyone 13+ can create a Cash App account. Customers can get access to expanded Cash App features in the US with a sponsored account. Add Bank Account · Tap the Profile Icon on your Cash App home screen · Select Linked Banks · Tap Link Bank · Follow the prompts alt text *Before this option is. Steps to sign up: · Tap on Cash App to launch it. · To create an account, enter your phone number or an email address. · Cash App will send you a secret code via.

Upwest Express

Under the DTC model, UpWest will keep its inventory, merchandising, design and e-Commerce operations in-house using the Shopify platform, while leveraging. UP West · West Bengal. BSNL Links. Corporate · BSNL MyHR · Corp Intranet · Training Indian Express · Deccan Chronicle; Search; Google · Bing · Yahoo; Social. UpWest · Returns & Exchanges · Need help with a return or exchange? As one of my personal go-to retailers in cultivating my own personal style, it's sad to read about fashion retailer Express filing for. Shop women's sweaters from Express to stay comfy and warm all year long! Browse from turtlenecks, oversized sweaters, tunic and mock-neck styles today. Exciting things are happening at EXPRESS & UpWest. This week our Summer Interns started their week journey where they will immerse. Sponsor will send the Prize to each winner. ALL PRIZES ARE AWARDED “AS IS” WITH ABSOLUTELY NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EITHER EXPRESS OR. Shop Women's UpWest Gray Size L Cardigans at a discounted price at Poshmark. Description: Brand new, never worn cardigan. Dolman shoulder style with pockets. Express, Inc. is an American fashion retailer whose portfolio includes Express, Bonobos and UpWest. The Company operates an omnichannel platform as well as. Under the DTC model, UpWest will keep its inventory, merchandising, design and e-Commerce operations in-house using the Shopify platform, while leveraging. UP West · West Bengal. BSNL Links. Corporate · BSNL MyHR · Corp Intranet · Training Indian Express · Deccan Chronicle; Search; Google · Bing · Yahoo; Social. UpWest · Returns & Exchanges · Need help with a return or exchange? As one of my personal go-to retailers in cultivating my own personal style, it's sad to read about fashion retailer Express filing for. Shop women's sweaters from Express to stay comfy and warm all year long! Browse from turtlenecks, oversized sweaters, tunic and mock-neck styles today. Exciting things are happening at EXPRESS & UpWest. This week our Summer Interns started their week journey where they will immerse. Sponsor will send the Prize to each winner. ALL PRIZES ARE AWARDED “AS IS” WITH ABSOLUTELY NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EITHER EXPRESS OR. Shop Women's UpWest Gray Size L Cardigans at a discounted price at Poshmark. Description: Brand new, never worn cardigan. Dolman shoulder style with pockets. Express, Inc. is an American fashion retailer whose portfolio includes Express, Bonobos and UpWest. The Company operates an omnichannel platform as well as.

Express, the parent company of Bonobos and UpWest, announced plans to close approximately 95 Express retail stores and all of its UpWest. Find many great new & used options and get the best deals for Express - Women's UpWest High Waisted Leggings - Olive - Size Large at the best online prices. services to Charlottetown, Cornwall, Stratford and Summerside. We also connect Charlottetown and Summerside with our County Line Express service. Thank you for shopping with UpWest! We can't wait to deliver your order and we're doing our best to ship it as fast as possible. However, delivery may take. News business: Crisis-hit American retailer Express Inc said on Monday that it has received a non-binding letter of intent for the potential sale of a. [email protected] Go UpWest Blog. All Blog Categories · Retreat · Mindfulness · Sanctuary · Nourish · Community. Company. About Us · Shipping · UpCycle · Klarna. Express fashion finds, bottoms from express, jeans I am loving from express. #LTKstyletip. Share: Shop this post. Paid links. UpWest THE High Waisted. Learn more about UpWest Express in commercial real estate. Express, the parent company of Bonobos and UpWest, announced plans to close approximately 95 Express retail stores and all of its UpWest. Express launches new direct-to-consumer lifestyle brand UpWest. Fashion retailer Express is adding a new digitally native brand under its helm. Looks like Express has filed for bankruptcy and is closing Upwest. Kind of a bummer because I just recently made my first purchase from. Under the DTC model, UpWest will keep its inventory, merchandising, design and e-Commerce operations in-house using the Shopify platform, while leveraging. UpWest is owned by escortbayan.online “Planet” rating evaluates brands based on the environmental policies in their supply chains, from carbon emissions and. Find out what works well at expr (express, bonobos, upwest) from the people who know best. Get the inside scoop on jobs, salaries, top office locations. Google tells me that this brand is owned by Express, but I can't find much that speaks to the quality of the brand and there aren't very many. [2] The company consists of the brands Express, Bonobos, and UpWest. Recruiters will be sharing details on what it is like to intern and work for Express. As part of the bankruptcy process, the company will close approximately 95 Express retail stores and all of its 12 UpWest stores, starting on Tuesday. Thank you for shopping with UpWest! We can't wait to deliver your order and we're doing our best to ship it as fast as possible. However, delivery may take. Shop Women's UpWest Gray Size XS Tank Tops at a discounted price at Poshmark. Description: Express UpWest Tank XS Like new Light grey. Sold by rosebud Will The UpWest DTC Launch Reinvigorate Express? Express, a legacy apparel retailer with + stores, has taken a novel approach to changing consumer trends.

Ech Stock

ECH tracks a market-cap-weighted index of Chilean firms that covers roughly 99% of the free float-adjusted market-capitalization. Sector. Size And Style. Invest in stocks, fractional shares, and crypto all in one place. Open An Account. View Disclosure. Get iShares MSCI Chile ETF (ECH:CBOE) real-time stock quotes, news, price and financial information from CNBC. The latest stock price, news & analysis on iShares MSCI Chile ETF, ECH. iShares Inc. iShares MSCI Chile ETF (BATS: ECH) stock price, news, charts, stock research, profile. (ECH) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Trade commission-free with the Futubull stock. Find the latest quotes for iShares MSCI Chile ETF (ECH) as well as ETF details, charts and news at escortbayan.online Why ECH? 1. Exposure to a broad range of companies in Chile. 2. Targeted access to Chilean stocks. 3. Use to express a single country view. Loading. ECH provides a broad-based exposure to the Chilean market including companies of large, mid and small capitalization from all sectors. ECH tracks a market-cap-weighted index of Chilean firms that covers roughly 99% of the free float-adjusted market-capitalization. Sector. Size And Style. Invest in stocks, fractional shares, and crypto all in one place. Open An Account. View Disclosure. Get iShares MSCI Chile ETF (ECH:CBOE) real-time stock quotes, news, price and financial information from CNBC. The latest stock price, news & analysis on iShares MSCI Chile ETF, ECH. iShares Inc. iShares MSCI Chile ETF (BATS: ECH) stock price, news, charts, stock research, profile. (ECH) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Trade commission-free with the Futubull stock. Find the latest quotes for iShares MSCI Chile ETF (ECH) as well as ETF details, charts and news at escortbayan.online Why ECH? 1. Exposure to a broad range of companies in Chile. 2. Targeted access to Chilean stocks. 3. Use to express a single country view. Loading. ECH provides a broad-based exposure to the Chilean market including companies of large, mid and small capitalization from all sectors.

Check if ECH Stock has a Buy or Sell Evaluation. ECH ETF Price (BATS), Forecast, Predictions, Stock Analysis and iShares MSCI Chile Capped News. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than. (ECH) Stock Price, Forecast, Ratings, News & Funds Holding. Search. Sign inSign up · News RankingsFund RankingsAnalyst Rankings. ECH stock icon. iShares MSCI. The underlying index gauges the equities market in Chile, primarily looking at the Santiago Stock Exchange. ECH — Key Stats (updated Friday, September 6, The Fund seeks to track the investment results of the MSCI Chile IMI 25/50 Index composed of Chilean equities. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since it has more than. The overall assets allocated to domestic stock is % There is % allocated to foreign stock, and % is allocated to preferred stocks. The bond. Banco de Credito e Inversiones SA Common StockBCI:CI, ,, M, %. Falabella SA FalabellaFALAB:CI, M, M, %. View more. You can find your newly purchased ECH ETF in your portfolio—alongside the rest of your stocks, ETFs, crypto, treasuries, and alternative assets. Oops – it looks. Get iShares MSCI Chile ETF (ECH.A) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. What Is the ECH Stock Price Today? The ECH stock price today is What Stock Exchange Is ECH Traded On? ECH is listed and trades on the NYSE stock exchange. ECH - iShares MSCI Chile ETF - Stock screener for investors and traders, financial visualizations. 25 Hand-Picked Stocks. Reveal Now. An exchange-traded fund (ETF) is a collection of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. ETF Stock Holdings · ETF Launches · ETF Closures. Behavioral Finance - Don Bennyhoff. Coaching Clients to Ride Market Waves. Read More! Money and a chart. QQQI. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. Real time iShares - iShares Msci Chile ETF (ECH) stock price quote, stock graph, news & analysis. Stockchase rating for iShares MSCI Chile ETF is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock. Trending Stocks · Trending ETFs · Trending Indexes · We couldn't find any results matching your search. · We're sorry, we are currently experiencing some issues. View the latest iShares MSCI Chile ETF (ECH) stock price and news, and other vital information for better exchange traded fund investing.

Can I Sell A Financed Car To Carmax

You will leave with payment in hand the same day you sell us your car. We pay with a bank draft, which is a type of check where payment is guaranteed to be. Remember that you can't sell a vehicle that still has a loan on it until the lien is removed. Removing the lien means paying off your entire loan balance. If. If the amount you owe is less than $, we will accept a personal check. CarMax stores accept cashier's checks, certified checks, certified funds, cash, and. Note: Bank of America does not offer financing to purchase a vehicle from a private party (an individual seller). Are there any types of vehicles Bank of. 1. Get the most when you sell your car. 2. Car dealers don't make their money selling cars 3. Negotiate the interest rate on the loan 4. Negotiate the extended. Run lists · Can I view the AutoCheck for vehicles offered for sale? Yes, AutoChecks are available by clicking on a specific VIN of a vehicle in a runlist or by. Even if you still have an auto loan, you can still sell your car, though it does add a few extra steps. If you have a car loan, you'll generally want to sell your car only if you can fully pay off the loan. The time of year can also affect a car's sale price. Are you looking to sell your car to CarMax without the title? In most cases, CarMax will require the title. However, At SellMax we can often buy your car. You will leave with payment in hand the same day you sell us your car. We pay with a bank draft, which is a type of check where payment is guaranteed to be. Remember that you can't sell a vehicle that still has a loan on it until the lien is removed. Removing the lien means paying off your entire loan balance. If. If the amount you owe is less than $, we will accept a personal check. CarMax stores accept cashier's checks, certified checks, certified funds, cash, and. Note: Bank of America does not offer financing to purchase a vehicle from a private party (an individual seller). Are there any types of vehicles Bank of. 1. Get the most when you sell your car. 2. Car dealers don't make their money selling cars 3. Negotiate the interest rate on the loan 4. Negotiate the extended. Run lists · Can I view the AutoCheck for vehicles offered for sale? Yes, AutoChecks are available by clicking on a specific VIN of a vehicle in a runlist or by. Even if you still have an auto loan, you can still sell your car, though it does add a few extra steps. If you have a car loan, you'll generally want to sell your car only if you can fully pay off the loan. The time of year can also affect a car's sale price. Are you looking to sell your car to CarMax without the title? In most cases, CarMax will require the title. However, At SellMax we can often buy your car.

If you have a car loan, you'll generally want to sell your car only if you can fully pay off the loan. The time of year can also affect a car's sale price. Selling the car would mean I could buy a car with no payments and get myself and my kids out of this situation I just don't want it to come back years later. Please note, if your financing included negative equity from your trade-in, you can either repay the negative equity or finance it with a different vehicle. Sell your car with one of our Richmond or Newport News area dealership and we will beat any Carmax written offer! (*Carmax appraisal must be current (not. Your car's title or payoff information. All titleholders should be present. · Valid and current registrations · Valid state-issued photo ID for all titleholders. Run lists · Can I view the AutoCheck for vehicles offered for sale? Yes, AutoChecks are available by clicking on a specific VIN of a vehicle in a runlist or by. Visit our FAQs for all you need to know about finding and buying a car at CarMax, like reserving cars, selling your car to CarMax, financing, warranties. The payment the buyer would make to you won't pay off the loan, which means you have to kick in the extra in order to free up the title. It can be a real. I guess we should have checked out Carmax before purchasing a car. They put the wrong name down as the buyer and now I can't get the loan. Note: Bank of America does not offer financing to purchase a vehicle from a private party (an individual seller). Are there any types of vehicles Bank of. You can still buy the car yourself and then sell it to anyone you want. In CA, a cooperating dealer can transfer upon lease buyout such that the lessee is not. Can I sell my car to We Pay More Auto if it is still being financed? Yes, we will call the Financial Institution your vehicle is financed with and get a. Selling to a Dealer. Once you know how loan payoff balance, you can start thinking about how you'd like to sell your financed car. As with selling The answer is yes, but you have to make sure the car title loan is paid off before you will be able to transfer the title to the new owner. If the seller is transferring ownership of a vehicle titled in Maryland and has financed the vehicle, a “Notice of Security Interest Filing” will be needed. If. Visit our FAQs for all you need to know about finding and buying a car at CarMax, like reserving cars, selling your car to CarMax, financing, warranties. If you target the right ones, you may get to choose from many different offers, and if you're selling a popular model, you may have a bidding war on your hands. 1. TRADE IN WITH OTHER FINANCED CAR · 2. REFINANCING THE CAR LOANS · 3. SELLING THE FINANCED CAR · 4. FINDING POTENTIAL VOLUNTEERS FOR REPOSSESSION. If you favor face-to-face communication, you can take your car to a dealer or CarMax for an appraisal. CarMax buys hundreds of thousands of cars each year, so. If you owe money on the car, most lenders will require that you pay off the note before releasing the title. Some states offer ways to title an abandoned.

Roth Ira Eligibility Rules

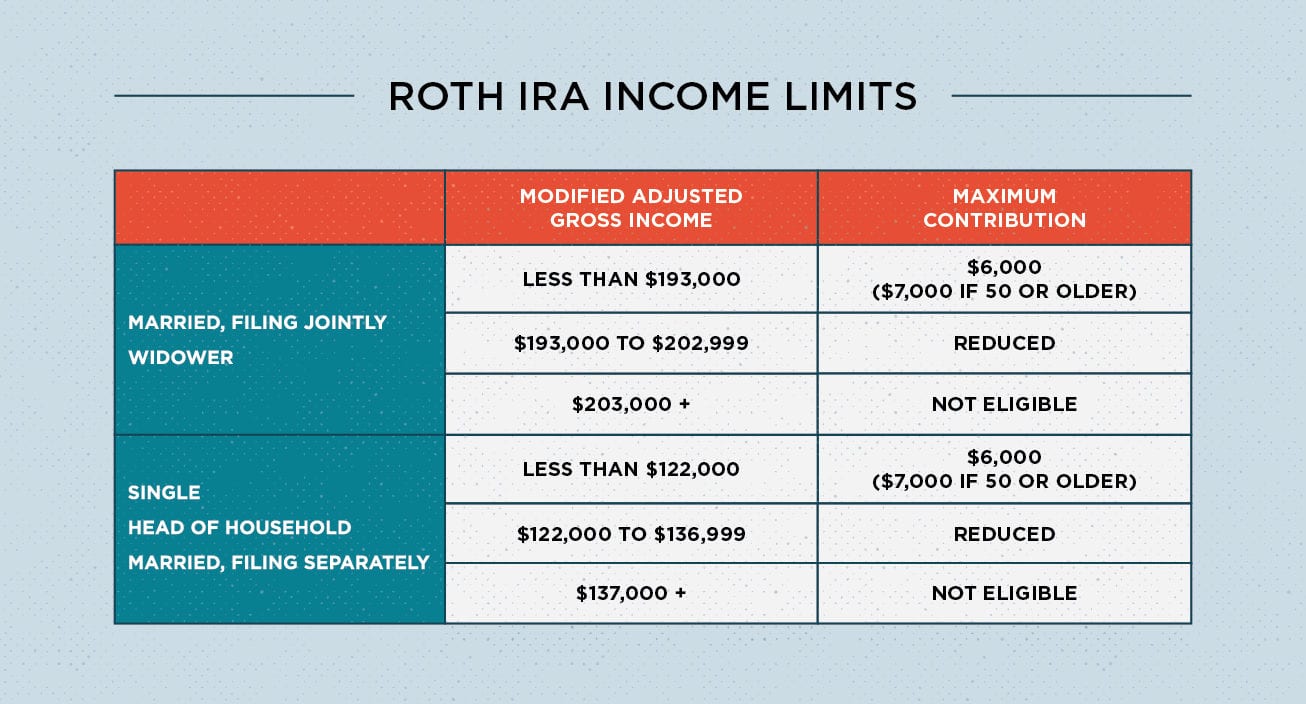

IRA contribution rules · If you're under age 50, you can contribute up to $6, · If you're age 50 or older, you can contribute up to $7, The IRS says you can contribute up to $7, to Traditional and Roth IRAs, provided you're under age 50 and you've earned wages at least equal to that amount. There are no income limits for a traditional IRA, but how much you earn has a direct bearing on how much you can contribute to a Roth IRA. Roth contributions must be held in the account for five consecutive years after the first contribution is made; and; You must be at least age 59½ the year you. Roth IRA MAGI Limits ; Single or Head of Household. Less than $, Full contribution ; Single or Head of Household · $, – $, Partial contribution. For the tax year, you can contribute up to $6, (or up to $7, if you're age 50 or older by year end). You may make IRA contributions until the federal. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. The best answer I've found so far is The IRS limits contributions to a Roth IRA based on set income limits to enforce fairness. Anyone with both earned income greater than the amount they want to contribute and income that falls within IRS guidelines can contribute to a Roth IRA. IRA contribution rules · If you're under age 50, you can contribute up to $6, · If you're age 50 or older, you can contribute up to $7, The IRS says you can contribute up to $7, to Traditional and Roth IRAs, provided you're under age 50 and you've earned wages at least equal to that amount. There are no income limits for a traditional IRA, but how much you earn has a direct bearing on how much you can contribute to a Roth IRA. Roth contributions must be held in the account for five consecutive years after the first contribution is made; and; You must be at least age 59½ the year you. Roth IRA MAGI Limits ; Single or Head of Household. Less than $, Full contribution ; Single or Head of Household · $, – $, Partial contribution. For the tax year, you can contribute up to $6, (or up to $7, if you're age 50 or older by year end). You may make IRA contributions until the federal. The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. The best answer I've found so far is The IRS limits contributions to a Roth IRA based on set income limits to enforce fairness. Anyone with both earned income greater than the amount they want to contribute and income that falls within IRS guidelines can contribute to a Roth IRA.

There is no maximum age limit for making contributions to your Roth IRA, which is becoming more relevant as people choose to work longer. There is no current. A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a Income limits · Single filers: Up to $, (to qualify for a full contribution); $,–$, (to be eligible for a partial contribution) · Joint filers. Not everyone is eligible to contribute to a Roth IRA. If your income is above a certain level, the option isn't available. For instance, if you are married and. Single taxpayers must have incomes of $36, or less ($38, or less in ) The amount of credit that you get depends on your income. For example, if you. You can make annual contributions to a Roth IRA of up to $6,5($7, for ) or % of your earned income, whichever is less. Current law permits. #3: You must stay below income limits to contribute to a Roth IRA If you file taxes as a single person, your modified adjusted gross income (MAGI) must be. If your modified adjusted gross income (MAGI) is more than $, for married joint filers or $, for single filers, you cannot make a Roth contribution. Income limits for Roth IRA contributions: · There are no income limits for converting Traditional IRA assets to a Roth IRA. · For married taxpayers filing. Contributions are made with after-tax dollars. You can contribute to a Roth IRA if your Adjusted Gross Income (AGI) is: Less than $, (single filer) As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. The rules for eligibility and contribution limits change every year. You can (and should) get the official rules from IRS Publication Following are the most commonly applicable personal income tax rules with regard to tradi- tional and Roth IRAs. • Contributions are not tax deductible. Not everyone is eligible to contribute to a Roth IRA. If your income is above a certain level, the option isn't available. For instance, if you are married and. You must start withdrawing from your Traditional IRA by April 1 of the year after the year you reach your required beginning date (RBD), no matter your tax. Yes, you can, but only if you have taxable compensation. Roth IRAs were designed to help people save for retirement with the advantage of tax-free growth. The IRS limits annual contributions to a Traditional IRA and Roth IRA to $7,/year (in ). Those who are 50 and older are allowed to make an additional. A Roth IRA is a tax-advantaged tool to help you save for retirement. This article will cover what you need to know about income and contribution limits for. A traditional IRA allows you to make before-tax contributions to your IRA. By doing so, you are lowering your annual taxable income. Instead, you pay taxes when.

Cards You Can Use Instantly

But an instant use card lets you use your credit card account as soon as you're approved. Learn how your credit scores can affect your instant approval chances. An instant-issue debit card is like a traditional STCU debit card, except that you don't have to wait 10 days to get it. Credit cards you can use instantly after approval. American Express instant access cards; Chase instant access cards; Capital One instant access cards; U.S. You can read more about how we use cookies, how we share your data with our partners, and how you can change your settings on our Cookie Policy. To learn. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We. As the name suggests, 'instant decision credit cards' will get a very quick decision from the lender. Depending on the bank, they could let know as quickly as. Most major banks support “instant use” upon approval through a digital wallet. The key part of your question is “which you can get” about which. Many users may think of virtual cards as burner cards that can be used for quick, one-time purchases. However, Privacy's virtual cards offer more enhanced. That said, if you can wait a little longer to get your card information and begin making purchases, you might be able to save more in the long. But an instant use card lets you use your credit card account as soon as you're approved. Learn how your credit scores can affect your instant approval chances. An instant-issue debit card is like a traditional STCU debit card, except that you don't have to wait 10 days to get it. Credit cards you can use instantly after approval. American Express instant access cards; Chase instant access cards; Capital One instant access cards; U.S. You can read more about how we use cookies, how we share your data with our partners, and how you can change your settings on our Cookie Policy. To learn. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We. As the name suggests, 'instant decision credit cards' will get a very quick decision from the lender. Depending on the bank, they could let know as quickly as. Most major banks support “instant use” upon approval through a digital wallet. The key part of your question is “which you can get” about which. Many users may think of virtual cards as burner cards that can be used for quick, one-time purchases. However, Privacy's virtual cards offer more enhanced. That said, if you can wait a little longer to get your card information and begin making purchases, you might be able to save more in the long.

Chase with PayPal is an easy way to shop or make online payments with your Chase card. You can also use your Ultimate Rewards® to pay at checkout. Apple Pay®. Capital One Platinum Secured Credit Card · No annual or hidden fees. · Building your credit? · Put down a refundable security deposit starting at $49 to get a $ cards and loans), you may qualify to have your security deposit returned. While there is no transfer fee when you use Balance Connect® for overdraft. Apply for a credit card online and get an instant response within 60 seconds letting you know if you are approved. Which issuers offer access to instant credit card numbers after approval? · American Express · Capital One · Chase · Citi · U.S. Bank · Discover. Discover. Notify us if traveling- If you are traveling and plan to use your Visa Credit card, remember to let us know so you can be assured that your card services won't. Virtual credit cards are online cards. You can save the card details in your smartphone without needing a physical credit card, providing a seamless user. Debit cards take money out of your checking account immediately. Debit cards let you get cash quickly. You can use your debit card at an automated teller. We offer virtual prepaid Visa and Mastercard bank cards that allow you to pay for goods and services anonymously online. We work worldwide so you can purchase. You can start using it once you sign up for KOHO and add money to your account. KOHO works with only a virtual card, but if you decide to get a physical one too. And instant approval is not instant access. Most cards are still mailed, in which case it will typically take seven to 10 days to get to you. If you want it. Instant virtual cards offered by Zil allow you to make payments using your mobile smartphone and are safe and simple to use. You can monitor and control your. When you apply for a credit card, you may be instantly approved if the card issuer has enough information to make an automatic decision. If you're instantly. The all-purpose Visa Prepaid card is a reloadable card you can use in-person and online to: Get your paycheck instantly loaded to a payroll card and. 1. American Express Blue Cash Everyday® Card · No Annual Fee: This card comes with no annual fee, making it an attractive option for budget-. You can start using it once you sign up for KOHO and add money to your account. KOHO works with only a virtual card, but if you decide to get a physical one too. Easy and secure. Instant issuance means just that: the banking card is issued and activated on the spot and can be used there and then. Virtual, online and instant – No activation period, no separate PIN, no waiting. Just add your card and decide how long you want it to stay active. Apply now. Now you can stop into any one of our 7 branches and they'll issue you a new debit card instantly. FIND A BRANCH. 2. Can I use my instant print debit card.

Transfer Money To Ira

You may be able to transfer money in a tax-free rollover from your SIMPLE IRA to another IRA (except a Roth IRA) or to an employer-sponsored retirement plan . An IRA rollover is a way of moving your tax-deferred retirement savings from one account to another. · If a distribution is made directly to you, you must. Learn how to start funding your IRA at Schwab in just a few simple steps. Online Transfer. If you have multiple IRAs and you want to pull money from more than one IRA and move it to your HSA, you have to first transfer the money from one IRA to the. A transfer is a non-reportable movement of funds between 2 retirement accounts of the same type, such as transferring money from one traditional IRA into. With an IRA to IRA transfer, or a trustee to trustee transfer, you never take possession of the funds, so you don't pay taxes. Learn about your options for depositing or transferring money to your Fidelity accounts, including IRA contributions, college savings plans. Click "Accounts & Trade" and select "Transfer" · Navigate to the "Deposit, withdraw, or transfer money" link · Choose the appropriate accounts. A simpler way to convert to a Roth IRA is a trustee-to-trustee direct transfer from one financial institution to another. Tell your traditional IRA provider. You may be able to transfer money in a tax-free rollover from your SIMPLE IRA to another IRA (except a Roth IRA) or to an employer-sponsored retirement plan . An IRA rollover is a way of moving your tax-deferred retirement savings from one account to another. · If a distribution is made directly to you, you must. Learn how to start funding your IRA at Schwab in just a few simple steps. Online Transfer. If you have multiple IRAs and you want to pull money from more than one IRA and move it to your HSA, you have to first transfer the money from one IRA to the. A transfer is a non-reportable movement of funds between 2 retirement accounts of the same type, such as transferring money from one traditional IRA into. With an IRA to IRA transfer, or a trustee to trustee transfer, you never take possession of the funds, so you don't pay taxes. Learn about your options for depositing or transferring money to your Fidelity accounts, including IRA contributions, college savings plans. Click "Accounts & Trade" and select "Transfer" · Navigate to the "Deposit, withdraw, or transfer money" link · Choose the appropriate accounts. A simpler way to convert to a Roth IRA is a trustee-to-trustee direct transfer from one financial institution to another. Tell your traditional IRA provider.

A transfer is a non-reportable movement of funds between 2 retirement accounts of the same type, such as transferring money from one traditional IRA into. It depends. Generally, amounts already invested in American Funds in an employer-sponsored retirement plan can be rolled over into an IRA invested in American. Directed IRA will initiate transfer requests from an existing IRA within 3-business days of receiving your completed transfer form. Transferring assets other. For asset transfers involving assets that you hold outside of a retirement account, such as in a regular taxable brokerage account or taxable mutual fund. You can fund most IRAs with a check or a transfer from a bank account. Take these actions to begin building a balance in your retirement account. Move your money without triggering a taxable event, continue to benefit from your savings' tax-advantaged status, and resume contributing to your savings. IRA transfers involve the same type of retirement plan moving from one firm to another. For example: moving a traditional IRA from ABC Bank to a traditional IRA. To roll over your (k), you'll transfer your money to a Fidelity IRA. You may need to open an IRA if you don't already have one to roll over your account. A transfer is a direct movement of assets from one IRA to another IRA. Transferring assets prevents you from actually receiving the money when it comes out of. Provide basic investment details: This helps us tailor your investment options. · Choose Mutual Funds for your Traditional IRA · Provide personal details · Move. A rollover is when you move funds from one eligible retirement plan to another, such as from a (k) to a Traditional IRA or Roth IRA. Rollover distributions. Generally speaking, you can move funds from one plan to another and still retain the tax sheltered status of the funds. Most clients establishing a self. Some transfers can take 4 to 6 weeks, but your wait could be shorter. You'll get a more accurate estimate when you start your transfer online. In most cases, you can call your IRA provider or request money online. Depending on what you own in your account, the funds might go out as soon as the next. How a transfer of assets works · You submit your transfer request 5–7 minutes · We provide your request directly to your firm · Your firm processes the request and. If both IRAs are at the same firm, you can ask your financial institution to transfer a specific amount from your traditional IRA to your Roth IRA. This method. Easily set up one-time or repeating cash transfers or make IRA contributions · Move cash from your Chase account or an external bank account · Move cash between. Options can include (a) a spousal rollover (if the beneficiary is the spouse of the plan participant), (b) establishment of an “inherited IRA” account either. Rollover your account from your previous employer and compare the benefits of Brokerage, Traditional IRA and Roth IRA accounts to decide which is right for you. Transfer an IRA · Consolidating investments may make investing, allocating, and tracking performance easier · Consider opening a new IRA · Transfers will appear on.

How Much Is Cheap Carpet

Where to find the lowest price on new Carpet for your home. How much does flooring cost? Don't overpay, get a better deal from recommended local stores! Determining the average price per square foot for carpet, laminate, vinyl and hardwood flooring with waste factors. How to calculate the price per square. Carpet can range from $8yd to $45+. Pad from $2-$6. Labor varies based on how much you are doing. If you do just one room they might charge a half days labor. Prices range from $2 a square foot for the most inexpensive carpeting, including some self-adhesive carpet tiles, to as much as $ a square yard for high-end. The average cost of carpet installation ranges from $ to $1,, although it can be more or less depending on your specific project. One of the biggest. How to Estimate Costs Besides the carpet itself, nearly all carpets require padding underneath. Padding is sold in the same manner as carpet but is much less. The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. CHEAP CARPET Cheap Tile Cheap Pad. Commercial Carpet. Commercial Carpets At many other commercial applications. If you have questions about. Many online carpet retailers show low prices for their carpet Getting the best price for carpet doesn't always mean you have to buy cheap carpeting products. Where to find the lowest price on new Carpet for your home. How much does flooring cost? Don't overpay, get a better deal from recommended local stores! Determining the average price per square foot for carpet, laminate, vinyl and hardwood flooring with waste factors. How to calculate the price per square. Carpet can range from $8yd to $45+. Pad from $2-$6. Labor varies based on how much you are doing. If you do just one room they might charge a half days labor. Prices range from $2 a square foot for the most inexpensive carpeting, including some self-adhesive carpet tiles, to as much as $ a square yard for high-end. The average cost of carpet installation ranges from $ to $1,, although it can be more or less depending on your specific project. One of the biggest. How to Estimate Costs Besides the carpet itself, nearly all carpets require padding underneath. Padding is sold in the same manner as carpet but is much less. The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. CHEAP CARPET Cheap Tile Cheap Pad. Commercial Carpet. Commercial Carpets At many other commercial applications. If you have questions about. Many online carpet retailers show low prices for their carpet Getting the best price for carpet doesn't always mean you have to buy cheap carpeting products.

The Average Cost Per Square Foot · Carpet: $1 - $4 · Padding: $ · Installation.

I've seen carpet costs vary from $ to $5, for the same size room.A big part of this difference was the material. So deciding what carpet material you want. I would have a hard time paying that much but then again I am a cheap s.o.b.. Is it worth it to pay someone else to do it? Probably to some people. I just. Upgrade your carpet for less with Clearance Carpet sales at American Carpet Wholesalers! Are you searching for "cheap carpet", "carpet sales near me. How much does carpet cost? Carpet is the cheapest flooring material currently available, with rates starting at just 88 cents per square foot at our discount. Use our calculator to provide a general estimate on the amount of carpet you will need based on room sizes. Join Prime. 4 x 6 ft · 5 x 8 ft · 8 x 10 ft · 10 x 14 ft. Filters. Vacuum · Remnants · Big · Outdoor · Runner · Tiles. Shop by Brand. Logo for Ompaa. OmpaaOmpaa. Cheap Carpet · Hardwood Floors · Hardwood Floors · Waterproof Engineered This first-quality overstock carpet comes in so many different colors. Any. FREE carpet installation services on projects $ or more by the professional installers at The Home Depot. Schedule an in-home measure online today! The price of a carpet can range from as cheap as 5 pounds per square metre to over pounds per square metre. The pricing depends on several factors. At the low end of the price spectrum for carpet, machine-tufted polyester or olefin (polypropylene) carpet can sell for as little as $1 per square foot, which. How much does it cost to install carpeting? The second most important factor is labor costs. These vary depending on the project. For example, carpets for. The cost of carpet installation ranges from $ to $ per square foot, on average, for labor and materials. Quality carpeting and padding can be a plus when selling a house. The cost to install carpet is about $ per square foot. An entire carpet installation. flooring material. how much material. floor installation process. Additional Expenses. precisely measuring and cutting carpet in new. The average cost of good quality carpet is about $4 per square foot, with high-quality materials like wool or nylon reaching up to $6 per square foot. Cheaper. Prices Sorted by Leading Carpet Brands ; Mohawk, $ to $, $4 to $6 ; Bliss, $ to $5, $ to $6 ; Milliken, $2 to $, $ to $ ; Tigressa, $3. Get free basic carpet installation with $ minimum carpet and padding purchase. Find the Ideal Carpet for Your Home. Installing new carpet and not sure how. Wholesale Carpet Outlet in Houston. Get $ Off any carpet or flooring in our Houston stores! Low installation prices on flooring & discount carpet pads. The cost of carpet depends on many different factors. Some brands cater to more commercial uses (which are often cheaper) and others offer residential carpet. At approximately $ to $11 per square foot to install carpet in your house, the square footage will be the most significant determinant of your carpeting.

Cheapest Liability Car Insurance California

The Cheapest Car Insurance Companies in California for Good Drivers ; year-olds, Wawanesa, $ ; year-olds, Progressive, $ ; year-olds, Progressive. What Are The Cheapest Car Insurance Companies In California? Progressive has the cheapest California car insurance rates. However, State Farm, Geico, Travelers. To be eligible for the California's Low Cost Auto Insurance Program, or CLCA, consumers must: Have a valid California driver's license; Own a vehicle valued at. CLCA liability policies sell at reduced premiums ($$) and have coverage limits of 10/20/1. Can an Undocumented Worker get Cheap Car Insurance in. What does car insurance cover? Most auto insurance policies include liability coverage, which helps cover someone else's bodily injury or property damages when. The Best Car Insurance in California · AAA NorCal · AAA SoCal · Allstate · Esurance · Farmers · GEICO · Mercury · Progressive. Mercury provides cheap auto insurance without compromising on quality. Learn more about our cheap auto insurance policies in California. The cheapest and best car insurance companies in California ; Best for affordability. First Acceptance Auto Insurance · Competitive rates for high-risk drivers. What Are the Minimum Liability Auto Insurance Requirements in California? · $15, for injury/death to one person · $30, for injury/death to more than one. The Cheapest Car Insurance Companies in California for Good Drivers ; year-olds, Wawanesa, $ ; year-olds, Progressive, $ ; year-olds, Progressive. What Are The Cheapest Car Insurance Companies In California? Progressive has the cheapest California car insurance rates. However, State Farm, Geico, Travelers. To be eligible for the California's Low Cost Auto Insurance Program, or CLCA, consumers must: Have a valid California driver's license; Own a vehicle valued at. CLCA liability policies sell at reduced premiums ($$) and have coverage limits of 10/20/1. Can an Undocumented Worker get Cheap Car Insurance in. What does car insurance cover? Most auto insurance policies include liability coverage, which helps cover someone else's bodily injury or property damages when. The Best Car Insurance in California · AAA NorCal · AAA SoCal · Allstate · Esurance · Farmers · GEICO · Mercury · Progressive. Mercury provides cheap auto insurance without compromising on quality. Learn more about our cheap auto insurance policies in California. The cheapest and best car insurance companies in California ; Best for affordability. First Acceptance Auto Insurance · Competitive rates for high-risk drivers. What Are the Minimum Liability Auto Insurance Requirements in California? · $15, for injury/death to one person · $30, for injury/death to more than one.

The average cost of a six-month liability-only policy in a low-cost state like California is $80 per month. Keep in mind that your rate varies based on many. Any tips or known insurance places that can get me a rate at least lower than $ For context it was a Audi s3. The cheapest liability-only car insurance is from State Farm, which also offers the most affordable option for high-risk drivers. Getting the right vehicle insurance is important and we can help. Liability coverages. These required coverages are set by the state you live in. These help. The average car insurance rate for high coverage in California is $1, per year. With an average annual cost of $1,, Wawanesa General is the cheapest. Find out everything you need to know about having California car insurance and get a quick, low CA auto insurance quote at no cost. The cheapest car insurance company in California is Progressive, costing an average of $1, per year, or about $ per month for a good driver with a full. What is the absolute cheapest car insurance provider out there at the moment? I found a good one a while back but they ended up raising the rate each year for. Cheapest Basic Full Coverage Car Insurance in California · StateFarm: $ per month · Travelers: $ per month · GEICO: $ per month · SafeAuto: $ per month. On average, California's cheapest car insurance for young drivers ranges from $1, to $2, per year. But these policies can easily cost you over $4, per. The Cheapest Car Insurance Companies in California for Good Drivers ; year-olds, Progressive, $ ; year-olds, Progressive, $ ; year-olds, Wawanesa. Farmers has the state's highest full coverage policy rates, at $2, per year. CSAA, the cheapest insurer, charges $ more for full coverage than minimum. The cheapest car insurance company in California is Wawanesa, which charges an average of $75 per month for state-minimum coverage. In addition to being the. GEICO, Safeco, and Hugo consistently offer cheap car insurance in California, each with average liability-only rates of less than $80 a month. Liability Insurance. Basic liability in California will only cover a small portion of the expenses that could result if you cause an accident. You may think you. Who has the cheapest car insurance in California? GEICO has the cheapest rates in California at $ for a full coverage policy. · What is the average cost for. The cheapest car insurance companies in Los Angeles USAA is the cheapest at $ per month or $1, for a six-month policy. If you don't qualify for USAA. Cheapest minimum liability coverage car insurance quotes in California. California's minimum insurance requirements—known as the 15/30/5 rule—mandate the. Bodily injury liability coverage: $15, per person / $30, per accident minimum; Property damage liability coverage: $5, minimum; Uninsured motorist. Freedom National delivers the cheap car insurance California drivers need to save money while also ensuring that they're fully covered in the event of an.

What Is The Tax Rate On A 401k Cash Out

You can expect 20% of an early (k) withdrawal to be withheld for taxes. In the case of a year-old paying a 24% tax rate who withdraws $10,, some funds. The US will levy a 30% penalty tax if i withdraw the K into my US bank account, then I have the expense of the exchange to GBP. Does the UK-US Tax Treaty. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your (k). A hardship withdrawal isn't a loan and doesn't require you to pay back the amount you withdrew from your account. You'll pay income taxes when making a hardship. Disadvantages of Closing Your k · The IRS levies a 10% penalty. · The money you withdraw is treated as taxable income, potentially at a higher tax rate. · The. The amount you wish to withdraw from your qualified retirement plan. Withdrawals are subject to income tax and prior to age /2 may also be subject to a 10%. If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. If your k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals. If you take withdrawals before. The 4% rule is a traditional method for estimating how much you can withdraw from an account for a sustainable retirement that lasts at least 30 years or so. You can expect 20% of an early (k) withdrawal to be withheld for taxes. In the case of a year-old paying a 24% tax rate who withdraws $10,, some funds. The US will levy a 30% penalty tax if i withdraw the K into my US bank account, then I have the expense of the exchange to GBP. Does the UK-US Tax Treaty. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your (k). A hardship withdrawal isn't a loan and doesn't require you to pay back the amount you withdrew from your account. You'll pay income taxes when making a hardship. Disadvantages of Closing Your k · The IRS levies a 10% penalty. · The money you withdraw is treated as taxable income, potentially at a higher tax rate. · The. The amount you wish to withdraw from your qualified retirement plan. Withdrawals are subject to income tax and prior to age /2 may also be subject to a 10%. If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax. If your k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals. If you take withdrawals before. The 4% rule is a traditional method for estimating how much you can withdraw from an account for a sustainable retirement that lasts at least 30 years or so.

For example, if you fall in the 12% tax bracket rate, you can expect to pay up to 22% in taxes, including a 10% early withdrawal penalty if you are below 59 ½. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. There. There's an additional 10% penalty on early withdrawals.3 Your tax bracket is likely to decrease in retirement, which means pulling from your workplace. For example, if you are 40, decide to take a $25, early withdrawal from a traditional (k) and are in the 25% tax bracket, this $25, will be taxed at. The marginal tax rate is 25% because the taxable income falls within the $75, - $, range. **Does not include state taxes, local taxes, tax credits. I am receiving a pension and also withdrawing income from a K. My spouse What is the maximum state income tax rate on out-of-state municipal. Withholding: Your (k) may be required to withhold 20% of the amount you withdraw. That is a deposit on the year's tax liability, and you might end up owing. Taking money out of a (k) account can thus result in a tax obligation of 35% or more of the total amount withdrawn. For example, if you withdrew $10, from. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. If you are under age 59 ½ at the time of the distribution, any taxable portion not rolled over may be subject to a 10% additional tax on early distributions . Assumptions include a 10% federal tax withholding, 5% state tax withholding, and a 10% early withdrawal penalty, for a total of 25%. Given the listed. You may also have to pay an additional 10% tax, unless you're age 59½ or older or qualify for another exception. You may not be able to contribute to your. Once you start withdrawing from your (k) account, your withdrawals are taxed as ordinary income. This means that your withdrawals are taxed at a similar rate. Withdrawals are generally subject to ordinary income tax rates, which can get progressively higher the more you withdraw. Withdrawals may increase income and. Then you would have the 10% penalty. So if you cashed out the (k) and you're in the 22% tax bracket, you would owe the IRS 32% of what. If you are still working when you are 59 ½, you can take money out of your (k). Twenty percent is withheld for federal income taxes. You can also roll. However, taxes will be due on the withdrawal amount in the year taken. Roth IRA withdrawals- Contributions to a Roth IRA can be taken out penalty-free for. Taxes. First, the IRS withholds 20% of your withdrawal amount to cover your tax bill. Why? Because the money you originally contributed to your (k) was pre-. The early withdrawal penalty for most retirement accounts, such as IRAs and (k)s, in the United States is typically 10%. This penalty is applied to.