escortbayan.online

Prices

What Degree Do You Need To Become A Web Developer

Consider earning an AAS or BS in computer science, web development and design, or another relevant discipline. You can also earn an associate's or bachelor's. Participate in boot camps or get a degree in web development. 2. Specialize as a Front-End, Back-End or Full-Stack Developer. 3. Improve your skills by. The best degree, by far, is a computer science degree. Web development is a subset of software development and most working software developers. But how do you become a web developer? Becoming a web developer is simpler than you think, and you might not need a college degree at all. Coding bootcamps and. With high-quality bootcamps and online coding courses available, you might not even need a degree. This article is a comprehensive guide for anyone wondering. A certification course in web development provides you with more opportunities to get your feet into this field. A web design and. To advance into management positions, web developers often need bachelor's degrees, and postsecondary teaching or research positions typically require. The short answer is no. These days, having a degree in computer science is not a requirement to find a job in web development. Consider earning an AAS or BS in computer science, web development and design, or another relevant discipline. You can also earn an associate's or bachelor's. Consider earning an AAS or BS in computer science, web development and design, or another relevant discipline. You can also earn an associate's or bachelor's. Participate in boot camps or get a degree in web development. 2. Specialize as a Front-End, Back-End or Full-Stack Developer. 3. Improve your skills by. The best degree, by far, is a computer science degree. Web development is a subset of software development and most working software developers. But how do you become a web developer? Becoming a web developer is simpler than you think, and you might not need a college degree at all. Coding bootcamps and. With high-quality bootcamps and online coding courses available, you might not even need a degree. This article is a comprehensive guide for anyone wondering. A certification course in web development provides you with more opportunities to get your feet into this field. A web design and. To advance into management positions, web developers often need bachelor's degrees, and postsecondary teaching or research positions typically require. The short answer is no. These days, having a degree in computer science is not a requirement to find a job in web development. Consider earning an AAS or BS in computer science, web development and design, or another relevant discipline. You can also earn an associate's or bachelor's.

Typically, an associate of science degree takes two years to complete, while earning a bachelor's degree in web development takes four years of full-time study. Becoming a web developer without college is possible. While a traditional 4-year degree may work for some people, it's simply not viable or desirable for others. Some aspiring Web Developers complete an associate or bachelor's degree in web development, computer science, information technology, or a related field. Others. Requirements range from a high school diploma to a bachelor's degree. What are common types of software I would have to learn as a Web Developer? You can definitely become a web developer without a CS degree. A lot of really good developers are self-taught. You can go for bootcamps. How to become Web developer ; University. You could do a foundation degree, higher national diploma or degree in: web design and development ; College. You could. Students may choose to major in computer information systems or computer science with a concentration in web development. Some programs also enable learners to. Education. Educational requirements for web developers and digital designers range from a high school diploma to a bachelor's degree. Some employers prefer to. The skills and education needed to succeed as a web developer depend on the specific type of web development, industry, and employer. Many web developers begin. A computer science or IT degree is not a requirement to become a web developer. Acquiring skills from a bootcamp or through self-study can also lead to a. Computer science is a huge step up from just web dev/IT. Depending on your area it should be relatively easy to pick up a job or even freelance. High school courses in algebra, trigonometry, calculus and English provide you with the initial preparation for further education with computers. You should. To become a Web Developer, you should have an understanding of HTML, CSS, and JavaScript. It's also recommended to learn about CSS and CSS frameworks. You do not need a degree to become a Web Developer. Up to two-thirds of entry-level web development roles do not list a degree as a requirement. In fact. Step 1: Pick the Skills You Need to Work in Web Development · Step 2: Start Learning Web Development and Put Your Skills in Practice · Step 3: Find the Right Web. A four-year degree is one of the most common educational routes into web development. According to a recent report from Stack Overflow, percent of surveyed. There's no universal requirement to become a web developer, though the majority of professionals in the field earned a bachelor's degree at some point. Today. Yes, you can definitely become a web developer without a CS degree. Having an arts degree does not restrict you from pursuing a career in web development. What skills do you need as a web developer? Web developers need proficiency in coding languages such as HTML, CSS, and JavaScript for front-end development. Some web developers are self-taught and secure jobs based on their experience, but many web developers complete 2-year or 4-year degree programs in computer.

Home Equity Line Of Credit To Pay Off Debt

A home equity loan is one way to pay off credit card debt. · Home equity loans generally charge much lower interest rates than most credit cards do. · The danger. A Home Equity Line of Credit (HELOC) can be a strategic financial tool for homeowners grappling with high-interest credit card debt. By consolidating your. Paying off debt sooner means you'll owe less in interest over the life of the loan, which saves you money. The simple way to do this is to decrease your charges. Is it a good idea to use my home's equity to pay off credit card debt? · Favorable interest rates. Interest rates on HELOCs tend to be lower than interest rates. A home equity loan is one way to pay off your credit card debt. It generally has a lower interest rate, but it can also put your home at risk. Home equity lines of credit are known lower interest rates than many consumer loans and could offer relief for those struggling with debt. If you have built up equity in your home but still have a mortgage balance to pay off, you may consider using a home equity line of credit (HELOC) to reduce. With HELOCs you can borrow funds over time as needed. They also offer flexible repayment options, including interest-only payments for those who qualify. Don't do it forever. Once you get the debt cleared get rid of the credit cards and the HELOC. A home equity loan is one way to pay off credit card debt. · Home equity loans generally charge much lower interest rates than most credit cards do. · The danger. A Home Equity Line of Credit (HELOC) can be a strategic financial tool for homeowners grappling with high-interest credit card debt. By consolidating your. Paying off debt sooner means you'll owe less in interest over the life of the loan, which saves you money. The simple way to do this is to decrease your charges. Is it a good idea to use my home's equity to pay off credit card debt? · Favorable interest rates. Interest rates on HELOCs tend to be lower than interest rates. A home equity loan is one way to pay off your credit card debt. It generally has a lower interest rate, but it can also put your home at risk. Home equity lines of credit are known lower interest rates than many consumer loans and could offer relief for those struggling with debt. If you have built up equity in your home but still have a mortgage balance to pay off, you may consider using a home equity line of credit (HELOC) to reduce. With HELOCs you can borrow funds over time as needed. They also offer flexible repayment options, including interest-only payments for those who qualify. Don't do it forever. Once you get the debt cleared get rid of the credit cards and the HELOC.

A home equity line of credit provides flexible funding options for when you need to start a new home improvement project, consolidate debt or pay for an. Open-end loans: HELOCs are open-ended meaning you borrow as you go — instead of borrowing a set amount of funds all at once, you withdraw and repay as needed. There are generally no restrictions on how you use a HELOC. If you want to consolidate debt by paying off a car loan and credit card debt, that's fine. The. A home equity loan may be a lower interest rate than your current debt, but make sure you know all the risks before consolidating your debt into one. A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. A HELOC is a secure, flexible way to help make repaying your debt more manageable — and potentially save more over time. HELOC loans have two phases: a set time period for you to use your credit line and another when you repay the balance you owe. Phase one: The HELOC draw period. Whereas a HELOC is a revolving line of credit, a home equity loan is a type of installment credit. credit card to pay off HELOC debt. This strategy may be. What Can You Use a HELOC For? · Home renovations · Paying off other debt (like the mortgage, student loans, credit cards or medical bills) · Retirement living. In this comprehensive guide, we delve into the intricacies of using home equity for debt consolidation, exploring the benefits and potential pitfalls of such a. You get the loan for a specific amount of money and it must be repaid over a set period of time. You typically repay the loan with equal monthly payments over a. You can use a HELOC to pay off debt by withdrawing from the credit line, repaying it and withdrawing from it again as needed — but only during the draw period. The big risk is that if you can't repay the home equity loan, you could lose your home. Not repaying your credit card debt can also have serious consequences. Tips for Managing a HELOC Responsibly · Use HELOC Funds Wisely · Make Timely Payments · Monitor Interest Rates · Don't Borrow More Than You Need. While it may. HELOC may give you a lower interest rate BUT you still need to pay it back soon so you don't exceed your current debt. From experience I can. Lower interest rates – Since you're using your home as collateral, your secured loan will typically have lower interest rates than credit card debt or an. Using a HELOC to consolidate credit card debt allows you to consolidate payments into one monthly payment. PLUS, chances are a HELOC will offer a lower APR than. Take advantage of the equity you've built to finance a major purchase or to consolidate debt with a home equity loan or line of credit. When facing a major expense, such as financing a home renovation, consolidating debt or paying for an education, some homeowners choose to borrow money against. After the draw period, borrowers usually have another 20 years to pay off the principal and interest. Interest rates are usually adjustable during the draw.

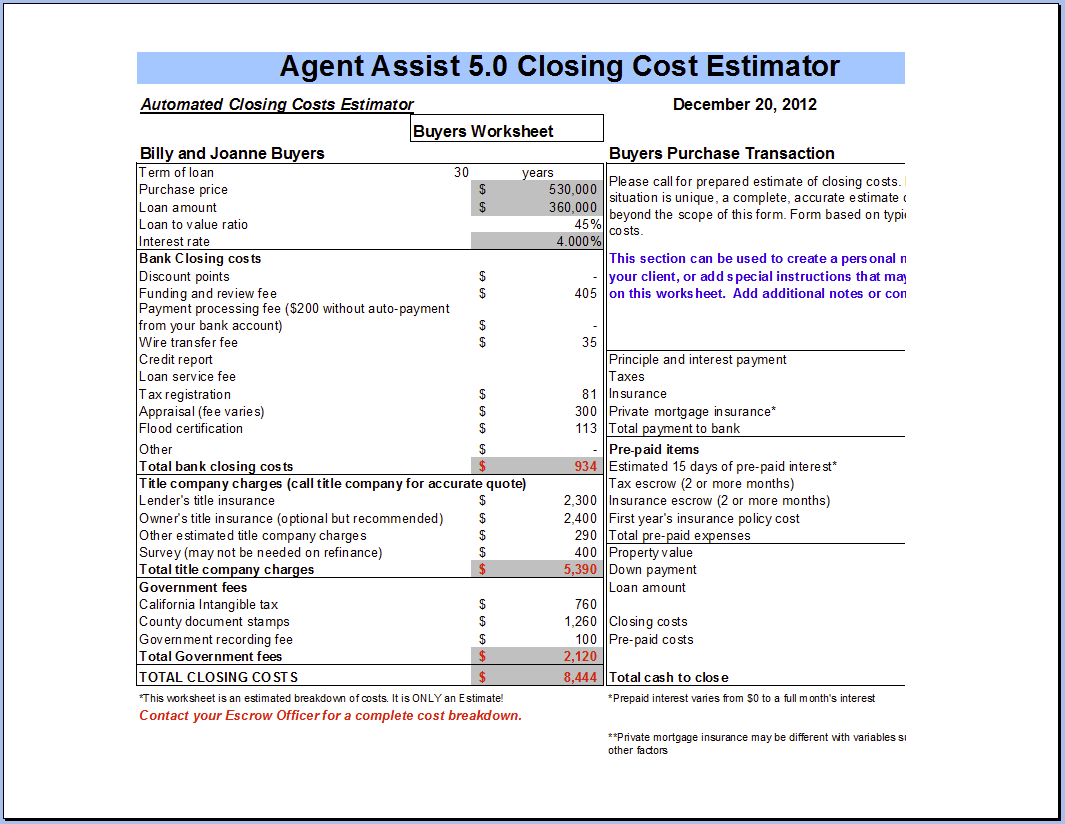

How To Determine Closing Costs For Buyer

We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. In general, a home buyer will incur closing costs roughly 3% to 6% of their loan amount, while the seller often pays roughly the same amount, primarily to their. Our closing costs calculator uses local data to show you price ranges for common fees to help you budget. Shop around for the best terms. Each point costs 1% of the mortgage balance. Points paid by the buyer are an expense due at closing. Application fee. Application fee for the loan required to. Closing costs can total between 2% and 5% of your loan amount and include things like lender fees, discount points, homeowners insurance, property taxes, and. Save all 6% in broker commission if you find a direct buyer, meaning you'll owe nothing at closing. If you decide to sell to a buyer represented by an agent. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Our calculator and guide provide a transparent breakdown of typical buyer closing costs in New York City, helping you financially prepare for your real estate. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges. In general, a home buyer will incur closing costs roughly 3% to 6% of their loan amount, while the seller often pays roughly the same amount, primarily to their. Our closing costs calculator uses local data to show you price ranges for common fees to help you budget. Shop around for the best terms. Each point costs 1% of the mortgage balance. Points paid by the buyer are an expense due at closing. Application fee. Application fee for the loan required to. Closing costs can total between 2% and 5% of your loan amount and include things like lender fees, discount points, homeowners insurance, property taxes, and. Save all 6% in broker commission if you find a direct buyer, meaning you'll owe nothing at closing. If you decide to sell to a buyer represented by an agent. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Our calculator and guide provide a transparent breakdown of typical buyer closing costs in New York City, helping you financially prepare for your real estate. We provide an overall closing costs estimate between 2% and 5% of the loan amount. We then factor in some of the most common closing cost charges.

Closing costs vary, but you can expect to pay anywhere from 2% to 6% of the loan amount. These fees don't include your down payment, so it's crucial to. Empower buyers with precision. Utilize our specialized closing cost calculator for buyer insights in real estate transactions. The most advanced buyer closing cost calculator in California. Your Closing Cost Summary, Property Location, Home Purchase Price, Down Payment, Buyer Agent. Typically, you should be prepared to pay between 2% and 5% of the home purchase price in closing fees. Estimate your total closing expenses for purchasing a. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. Your lender will provide you with a loan estimate of your fees prior to settlement to help prepare you for your closing costs. As an estimate, these fees. A closing cost calculator can estimate the amount of your closing costs, which can be helpful from a budgeting and preparation perspective. Most single-family home appraisals cost between $ and $1,, with a national average of $, according to Fixr. Discount points. Your lender might offer. There are a number of required services that can be chosen by the buyer, rather than the lender. If the estimated closing costs on your mortgage seems a little. The state or county in which you are buying a house; The lender you choose and their requirements; The type of mortgage you are getting; The real estate agents. Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property location, and include costs such. Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property location, and include costs such. Use our calculator to estimate how much you might pay in closing costs for your new home. In the United States average closing costs for homeowners are about $3,, though that depends heavily on home price and location. ClosingCorp averaged. The most advanced buyer closing cost calculator in New York. Your Closing Cost Summary, Property Location, Home Purchase Price, Down Payment, Buyer Agent. The lender is the one who determines your closing costs. When you apply for a home loan, the lender will provide you with a list of estimated closing costs. Our closing cost calculator estimates your total closing costs if you are buying a house. Closing costs are usually 2% - 5% of the loan amount. Policies that ensure the property can be transferred legally cover both the buyer and lender. They are calculated based on the purchase price. Homeowners. Buyers should review the initial loan estimate carefully. If a lender can't explain a fee or pushes back when queried, it may be a red flag. It's not uncommon. Buyers and Sellers, here's a good estimate of the closing costs that you'll be required to pay on your transaction in New York City.

Can You Bet On The Wwe

Go to your sportsbook and look at the betting odds for wrestling, look for matches that have pick'em odds or an underdog less than + Get the latest betting odds & lines for WWE If the NFL team you back fails to score at least one point, your point-spread bets will be refunded up to $ Yes, it is % legal to make a bet based on insider information. The sports betting industry is not regulated the way the financial markets is. how to bet on wwe|wwe betting online: Slots Online! Bônus Grátis How to Bet on WWE and Pro Wrestling by Odds Shark [Guide] You can't get rich from pro. WWE & WRESTLING BETTING ODDS You can bet on WWE and Wrestling right here at Grosvenor Sport. Simply put, there's nothing like watching and betting on. How to gamble responsibly on online WWE betting sites Before we end this article, we need to caution you to always bet responsibly. To ensure you're being. On this page you will find information on how to bet on WWE events + matches, the best sites for legal WWE betting, and the different bet types for Vince. We have all the WWE odds, so you can place your bets at BetUS Sportsbook & Casino. Go and check our lines for our Entertainment Sports and win big. And while WWE is generally scripted in order to provide thrilling entertainment for fans inside stadiums and watching on TV, you can bet on all the action. Go to your sportsbook and look at the betting odds for wrestling, look for matches that have pick'em odds or an underdog less than + Get the latest betting odds & lines for WWE If the NFL team you back fails to score at least one point, your point-spread bets will be refunded up to $ Yes, it is % legal to make a bet based on insider information. The sports betting industry is not regulated the way the financial markets is. how to bet on wwe|wwe betting online: Slots Online! Bônus Grátis How to Bet on WWE and Pro Wrestling by Odds Shark [Guide] You can't get rich from pro. WWE & WRESTLING BETTING ODDS You can bet on WWE and Wrestling right here at Grosvenor Sport. Simply put, there's nothing like watching and betting on. How to gamble responsibly on online WWE betting sites Before we end this article, we need to caution you to always bet responsibly. To ensure you're being. On this page you will find information on how to bet on WWE events + matches, the best sites for legal WWE betting, and the different bet types for Vince. We have all the WWE odds, so you can place your bets at BetUS Sportsbook & Casino. Go and check our lines for our Entertainment Sports and win big. And while WWE is generally scripted in order to provide thrilling entertainment for fans inside stadiums and watching on TV, you can bet on all the action.

We've handpicked the best five bookmakers below, offering numerous betting lines, great signup bonuses and promotions, and many other great features. With the Unibet Sports betting app you can bet on your favorite WWE match anytime anywhere! Download Unibet Canada's sports betting app to find out more! WWE. How To Bet On WWE Wrestling · 1. Match Winner: This is the most straightforward type of bet, where you simply choose the wrestler you believe will win a. FanDuel makes sports betting easy. You can bet on games, players, and even get a free trial of NFL Sunday Ticket! You can even check out NFL team odds, NBA team. While everyone knows that professional wrestling is pre-scripted, you can still place bets on the WWE and other major wrestling promotions. WWE in Entertainment Betting, Odds & Players Remember that you always risk losing the money you bet, so do not spend more than you can afford to lose. Yes, you can bet on WWE matches with some online betting sites. Although it may not be as popular as betting on other sports such as football or horse racing. Yes. Similar to other combat sports such as boxing or MMA, you can bet on multiple WWE fights in one single wager in order to increase the odds. Parlay betting. Yes. You can bet on WWE with Bet UK and get access to great odds. Bet on superstars like Roman Reigns and Seth Rollins, and wager on the biggest. No, WWE betting is not legal just escortbayan.online betting sites15 de ago. de — The top WWE wrestling superstars will take the stage at the WWE Money in the Bank. While DraftKings offers a variety of sports and betting options available to customers, DraftKings doesn't offer Wrestling markets, such as WWE or AEW for. How To Bet on WWE? · Click this link to visit BetOnline. · Click "Join Now" and register an Account. · The Wrestling section will be located under Other Sports. Yes, as long as the bookmaker offers betting on WWE on mobile through a user-friendly app. If you want to learn more about the Bet app and how to get it. can you bet on wwe [escortbayan.online] When it comes to bonuses and promotions, you'll want to know about ongoing promotions, loyalty programs, VIP benefits, and how. This guide has been created to let readers know about the highest-rated pro wrestling betting sites that offer odds on matches. The most basic betting option on a WWE match is "who will win the match?" This means that they must be declared the winner at the conclusion of the match and. Does The WWE Want To Allow Gambling On Their Scripted Matches? You Bet! - Valuetainment, Can You Bet On Wwe | Embarque em uma Aventura Picante com site de. In this blog post, we will list the best betting sites that offer odds on WWE matchups. We'll also provide some tips for how to bet on wrestling matches and. Signature Move. WWE betting lines are common, and signature moves is one such market. You can place a bet on how many times a superstar will perform their. How to win betting on WWE? While winning in WWE betting is never guaranteed, adopting effective strategies can enhance your chances. This section explores.

Insurance On Rvs

Insure your recreational vehicle — or truck and van camper — against damage and loss caused by common risks, such as fire, storms, theft and collision. Talk to a Farmers® representative about insurance for your recreational vehicle. Learn about all the options and potential discounts so you can choose the. GEICO offers a range of coverages such as total loss replacement and vacation liability to protect your RV and provide you with peace of mind while on the road. The type of RV insurance you need depends on the type of RV you have and how you use it. We'll address all of this and more. Let AAA help protect your recreational vehicle, motor home, travel trailer, pickup cap and camper. Get a free RV insurance quote from a AAA insurance agent! RV policies cover if and when in an accident on the road or if another driver has losses. Explore coverage options for your next adventure. See how much you could save when you get an RV insurance quote with Liberty Mutual and only pay for what you need. Call us at RV insurance from Nationwide offers protection when you need it most. Find out more about our affordable rates and start your free quote today. Get a quote and bind your RV policy online in minutes with the Good Sam Insurance Agency. You can also call to speak with an agent. Insure your recreational vehicle — or truck and van camper — against damage and loss caused by common risks, such as fire, storms, theft and collision. Talk to a Farmers® representative about insurance for your recreational vehicle. Learn about all the options and potential discounts so you can choose the. GEICO offers a range of coverages such as total loss replacement and vacation liability to protect your RV and provide you with peace of mind while on the road. The type of RV insurance you need depends on the type of RV you have and how you use it. We'll address all of this and more. Let AAA help protect your recreational vehicle, motor home, travel trailer, pickup cap and camper. Get a free RV insurance quote from a AAA insurance agent! RV policies cover if and when in an accident on the road or if another driver has losses. Explore coverage options for your next adventure. See how much you could save when you get an RV insurance quote with Liberty Mutual and only pay for what you need. Call us at RV insurance from Nationwide offers protection when you need it most. Find out more about our affordable rates and start your free quote today. Get a quote and bind your RV policy online in minutes with the Good Sam Insurance Agency. You can also call to speak with an agent.

We offer RV insurance, camper insurance, and travel trailer insurance that protects you so you can get out and satisfy your wanderlust. RV INSURANCE. Get outdoors and enjoy. By saving money with A-MAX RV or travel trailer insurance, you'll be able to take a road trip with friends and family to. It offers coverage for your RV as both a dwelling and a vehicle. Coverage includes Comprehensive, Collision, Liability, Contents and Medical Payments. Some. With FMCA RV Insurance, members can select from the industry's top RV underwriters at the best rates. Full-time RV insurance provides additional coverage for trailers and motorhomes used as a permanent residence for more than half the year. Insurance isn't required by law for travel trailers. Liability coverage is required on the vehicle that tows the RV, meaning your auto insurance policy will. RV coverage that protects you anywhere you find yourself. Find a local rep Or call COUNTRY (), and we'll help you find RV insurance that works. GEICO offers specialized RV insurance or travel trailer insurance to help protect you and your belongings at an affordable rate. We offer dozens of options from insurers in your area. escortbayan.online will find you the top trailer and best RV insurance companies, no matter what type of. RV insurance also known as Recreational Vehicle insurance or motor home insurance, protects against damages and liability arising from accidents, vandalism. RVs, motorhomes and travel trailers are unique vehicles which need dependable insurance coverage from a specialist, like National General Insurance. Michigan requires RV insurance for motorhomes that includes property protection insurance, personal injury protection, and liability coverage. Safeco can insure almost any recreational vehicle. This includes Class A, B, and C motorhomes with values up to $1 million. We also cover fifth wheels and. At Freeway Insurance, we offer competitive RV and motorhome insurance rates for your peace of mind. Personal property coverage helps mitigate costs associated with losing covered personal property. It must be contained in, attached to or used in connection. USAA offers RV insurance for your motorhome, travel trailer, camper and fifth wheel. Learn more about RV insurance costs, rates and coverage. Your RV or motorhome insurance from Acceptance can also save you money and keep your finances protected. You can receive a free online RV insurance quote, call. A basic policy for Class B RVs and camper vans is called liability coverage. It covers someone or someone else's property in the event of an accident. General RV is proud to partner with America's Choice Insurance Partners to provide our customers with the very best RV insurance in the industry. Progressive had next level RV insurance. Now don't get that mixed with their trash automotive department. Their RV insurance is great tho. Or USAA if you/.

Is It Bad To Refinance A Home

Refinancing is always a good idea if you can get an interest rate that is at least 1% lower than you are currently paying. How refinancing your mortgage can pay for your home improvement · Hire painters to spruce up your home's interior · Get new appliances · Add energy-efficient. So if refinancing saves $ a month, but costs, $ to do, your break even is 1 year. If you don't anticipate hitting that point, don't refi. If you miss enough payments, you risk losing the house. A cash out refinance should not be approached with the same nonchalance as opening a Macy's credit card. Renewing and refinancing the mortgage of your home requires careful planning because let's face it - you will be adding more debt on your. Cons of refinancing a mortgage · Higher interest rate or monthly payment: If you refinance your mortgage without any significant reduction in your interest rate. If you refinance, you get the opportunity to lower your interest rate and save thousands of dollars off your total loan payment. Read more. Can refinancing be a bad idea? Again, there's no simple answer but for some homeowners it does not make smart financial sense. Refinancing “successfully”. Renewing and refinancing the mortgage of your home requires careful planning because let's face it - you will be adding more debt on your. Refinancing is always a good idea if you can get an interest rate that is at least 1% lower than you are currently paying. How refinancing your mortgage can pay for your home improvement · Hire painters to spruce up your home's interior · Get new appliances · Add energy-efficient. So if refinancing saves $ a month, but costs, $ to do, your break even is 1 year. If you don't anticipate hitting that point, don't refi. If you miss enough payments, you risk losing the house. A cash out refinance should not be approached with the same nonchalance as opening a Macy's credit card. Renewing and refinancing the mortgage of your home requires careful planning because let's face it - you will be adding more debt on your. Cons of refinancing a mortgage · Higher interest rate or monthly payment: If you refinance your mortgage without any significant reduction in your interest rate. If you refinance, you get the opportunity to lower your interest rate and save thousands of dollars off your total loan payment. Read more. Can refinancing be a bad idea? Again, there's no simple answer but for some homeowners it does not make smart financial sense. Refinancing “successfully”. Renewing and refinancing the mortgage of your home requires careful planning because let's face it - you will be adding more debt on your.

A cash-out refinance works best when you are also able to score a lower interest rate on your new mortgage, compared with your current one. So, when does it. Is it bad to refinance your home multiple times? Generally, refinancing every few years is a smart move to ensure you still have a competitive home loan as. Has your income increased? Do you need to consolidate debt? Has the equity in your home increased? Do you need money for a major expense? Another reason to be wary of a home-refinance before selling is that it could make it more difficult to qualify for a mortgage on your new house. This is. Refinancing your home means the lender will pull your credit score. The pull will be a hard inquiry and may result in a temporary dip in your score. Closing out. Borrowers with less than perfect, or even bad credit, or too much debt, refinancing can be risky. In any economic climate, it can be difficult to make the. If the savings you earn from refinancing for a lower interest rate does not equal or exceed the closing costs you already paid, it might not be worth the effort. If you're thinking about refinancing your mortgage, although you may gain an improved loan, it also may negatively affect your credit score. Refinancing will hurt your credit score a bit initially, but might actually help in the long run. Refinancing can significantly lower your debt amount and/or. The three main strategies are breaking the mortgage early, adding a home equity line of credit (HELOC), or blending and extending. It's not impossible to refinance a mortgage with bad credit. Still, it can be challenging unless you do your homework first. So, paying a higher interest rate on a mortgage refinance might be a good financial decision if that higher rate is still lower than the interest rates on your. You have too much debt; You have bad credit; Your home value has dropped; Your application was incomplete; Your lender can't verify your information; You don't. Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest. With interest rates trending downward over the last several months, refinancing is all the rage. For many homeowners, refinancing an existing mortgage to a. Homeowners who are more than halfway through their year mortgage will likely not benefit from a refinance. Stretching the remaining payments over a new Refinancing might be the best choice if your primary goal is to lower your monthly payment or pay off your mortgage faster. If you want cash for improvements. Refinancing could reduce your monthly payment and overall loan costs if rates have dropped since you got your existing mortgage. Switch to a shorter or longer. There is usually no limit on how often you can refinance and no right or wrong number of times to refinance—just the number of times refinancing makes.

Macafee Price

For item price, visit your local Costco warehouse. E-delivery. $5 OFF. $5 manufacturer's savings is valid 8/19/24 through 9/8. Mcafee, Antivirus, 1 PC, 1 Year. MRP: ₹ Original price was: ₹ Sale Price: ₹ Current price is: ₹ (Inclusive of all Taxes). McAfee Antivirus Protection Cost and Plan Pricing · Antivirus software starts at $ a year · VPN, password manager, identity theft protection, and bundle. Mcafee, Antivirus, 1 PC, 1 Year. MRP: ₹ Original price was: ₹ Sale Price: ₹ Current price is: ₹ (Inclusive of all Taxes). Works Globally · Works only on Windows · % GENUINE · We will send activation Key & McAfee Official download link to your email · Lowest Price Guaranteed. Applied Filters Clear All. McAfee. 11 Results. Sort by: Lowest Price, Highest Price, Relevance, Shipping Speed. Save. Sign in or create an account to save this. McAfee+ plans safeguard your life online with advanced privacy features, 24/7 identity monitoring, alerts, restoration and AI powered security for your devices. McAfee Antivirus Software at Office Depot & OfficeMax. Shop today online, in store or buy online and pick up in stores. Around-the-Clock Security Specialists: All the confidence you need ; $$ · Windows ; $$ · All Systems. For item price, visit your local Costco warehouse. E-delivery. $5 OFF. $5 manufacturer's savings is valid 8/19/24 through 9/8. Mcafee, Antivirus, 1 PC, 1 Year. MRP: ₹ Original price was: ₹ Sale Price: ₹ Current price is: ₹ (Inclusive of all Taxes). McAfee Antivirus Protection Cost and Plan Pricing · Antivirus software starts at $ a year · VPN, password manager, identity theft protection, and bundle. Mcafee, Antivirus, 1 PC, 1 Year. MRP: ₹ Original price was: ₹ Sale Price: ₹ Current price is: ₹ (Inclusive of all Taxes). Works Globally · Works only on Windows · % GENUINE · We will send activation Key & McAfee Official download link to your email · Lowest Price Guaranteed. Applied Filters Clear All. McAfee. 11 Results. Sort by: Lowest Price, Highest Price, Relevance, Shipping Speed. Save. Sign in or create an account to save this. McAfee+ plans safeguard your life online with advanced privacy features, 24/7 identity monitoring, alerts, restoration and AI powered security for your devices. McAfee Antivirus Software at Office Depot & OfficeMax. Shop today online, in store or buy online and pick up in stores. Around-the-Clock Security Specialists: All the confidence you need ; $$ · Windows ; $$ · All Systems.

Description McAfee Antivirus for QTS protects your data from viruses and malware. You can manually start or schedule scans, quarantine malicious files. Buy McAfee®+ Premium Individual Antivirus and Internet Security Software Price when purchased online. Is this the right location? Digital delivery. Pricing is subject to change. If the renewal price changes, we will notify you in advance so you always know what's going on. You can cancel your subscription. price is. Sign in or Create an Account to Save Your Cart! Sign in or Create McAfee has an extensive range of offerings, including McAfee Antivirus, McAfee. McAfee AntiVirus Protection | 1 PC (Windows)| Cybersecurity software includes Antivirus Protection, Internet Security Software | 1 Year Subscription |. Made in America is a Staples program to support American owned businesses. Price is, Regular price was $, You save 77%. $ 1. 1. McAfee doesn't overcomplicate its pricing structure, providing its users with five tiers to choose from depending on their internet security requirements. As. Mcafee(22) ; current price $ ; current price $ ; current price $ ; current price $ ; current price $ McAfee Internet Security - 1-Year / 1-Device. Price$ · Trend Micro Antivirus · McAfee Internet Security - 1-Year / Devices. Regular Price$Sale. Should you buy McAfee LiveSafe? We tested its ✓ protection ✓ performance ✓ usability ✓ prices, and more. Read our full McAfee Antivirus LiveSafe Review. *First year price. Introductory Pricing for New Customers. See offer details. Manage your protection features from one centralized dashboard. set the default. This article shows you how to find the renewal costs for expired and active McAfee subscriptions on the My Account page. McAfee will email you a reminder of. Made in America is a Staples program to support American owned businesses. Price is, Regular price was $, You save 77%. $ 1. 1. Shop for mcafee antivirus at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. McAfee Corp formerly known as McAfee Associates, Inc. from to 19to , Network Associates Inc. from to , and Intel Security. *Price shown is for first year. See offer details below. Antivirus price (e.g., first term price vs. each year thereafter). Pricing is subject. McAfee Software - Buy McAfee Software Online at Best Prices in India - Huge Collection of Branded Laptops/Computers and Accessories. McAfee Internet Security - 1-Year / 1-Device. Price$ · Trend Micro Antivirus · McAfee Internet Security - 1-Year / Devices. Regular Price$Sale. price (available only to customers without an existing McAfee subscription) and the renewal subscription price (e.g., first term price vs. each year thereafter). Price. Price. Buying Format. Buying Format. All filter applied. All Filters McAfee Total Protection | Antivirus Internet Security Software | Download.

Is Loan Consolidation Good

“Debt consolidation may be a better choice if the total debt amount is manageable and you have a high credit score,” says Matthews. “Debt settlement could be a. Debt consolidation can help when you have many loans across several financial institutions. The variety of terms, rates and monthly payments can be confusing to. Pros and Cons of Consolidating Federal Student Loans · Longer repayment period · Pay more interest overall and make more payments · Unpaid interest is added to. We'll often pay a lower interest rate with a consolidation loan than we would with hire purchase and credit card debt. However, debt consolidation won't help if. If you currently have federal student loans with multiple loan servicers, consolidation can greatly simplify loan repayment by giving you a single loan with. Common uses for a personal loan ; Upstart · % - % · 36 - 84 months ; Upgrade · % - % · 24 - 84 months ; SoFi · % - % (with AutoPay) · 24 - Consolidating debt can help you simplify and take control of your finances. Combine balances and make one set monthly payment with a debt consolidation. You could save money on interest and pay off your debt faster. 89% of surveyed debt consolidation customers told us they paid off existing debt sooner with a. If you have several major bills that need to be paid monthly, consider this the first sign that debt consolidation could be a good next step for you. “Debt consolidation may be a better choice if the total debt amount is manageable and you have a high credit score,” says Matthews. “Debt settlement could be a. Debt consolidation can help when you have many loans across several financial institutions. The variety of terms, rates and monthly payments can be confusing to. Pros and Cons of Consolidating Federal Student Loans · Longer repayment period · Pay more interest overall and make more payments · Unpaid interest is added to. We'll often pay a lower interest rate with a consolidation loan than we would with hire purchase and credit card debt. However, debt consolidation won't help if. If you currently have federal student loans with multiple loan servicers, consolidation can greatly simplify loan repayment by giving you a single loan with. Common uses for a personal loan ; Upstart · % - % · 36 - 84 months ; Upgrade · % - % · 24 - 84 months ; SoFi · % - % (with AutoPay) · 24 - Consolidating debt can help you simplify and take control of your finances. Combine balances and make one set monthly payment with a debt consolidation. You could save money on interest and pay off your debt faster. 89% of surveyed debt consolidation customers told us they paid off existing debt sooner with a. If you have several major bills that need to be paid monthly, consider this the first sign that debt consolidation could be a good next step for you.

Simply put, the consolidation loan is one new, larger loan that's used to pay off the other loans you currently have. One of the best ways to consolidate your. Debt consolidation is a good idea if you feel overwhelmed by multiple debts and can simplify them into one monthly payment with a lower interest rate. It can. If you decide to consolidate, you can choose your servicer – Good News, MOHELA can be your choice! The entire process typically takes between four and six weeks. Not only can debt consolidation help you save money, it can also help you feel more financially organized. When you apply for a debt consolidation loan, the. Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some. Consolidation can be an extremely useful repayment strategy — provided you understand the ins, the outs and how the process could impact your credit scores. Is a debt consolidation loan a good idea in your situation? When debt consolidation loans work, they can provide immense relief from credit cards and other. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. But it's important to remember that, while debt consolidation offers short-term benefits, it may not be your best long-term solution. Before applying for a. Debt consolidation can help you combine your debts into more manageable chunks. With fewer payments—and potentially lower interest rates—you might be able to. Debt consolidation is a good way to get on top of your payments and bills when you know your financial situation. The biggest benefit to an unsecured debt consolidation loan is that no property is at risk. And, while the interest rate might be higher than a secured loan, it. Debt consolidation refers to taking out one loan to pay off other loans. This is particularly useful to people who want to consolidate credit card debt. In fact, it may actually improve your ability to qualify. One thing that a lender will assess during the mortgage or refinancing review is your debt-to-income. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to find. Debt consolidation is when you combine several debts, whether it's loans, medical bills, car payments or credit cards, into one monthly payment—ideally with a. Debt consolidation can help you gain control of your finances and take you further on your journey to financial wellness. Consolidation could lower your. A loan through Prosper is also one of your best options for debt consolidation because you will have personalized support on call. Prosper provides Customer. In fact, it may actually improve your ability to qualify. One thing that a lender will assess during the mortgage or refinancing review is your debt-to-income. While debt consolidation does not erase debt, it can help you manage your debt more effectively. Pros for Debt Consolidation. Fewer accounts to manage.

Top 10 Homeowners Insurance Companies In Texas

Top 10 Best Homeowners Insurance in Dallas, TX - August - Yelp - Royalty Insurance, Farmers Insurance - Kelly Harris, Lakewood Insurance. At PURE, insurance is about more than just the things we protect. Discover our range of insurance coverage solutions, perfect for high net worth. Top 10 Writers of Homeowners Insurance in Texas* · 1. State Farm · 2. Allstate Corp. · 3. USAA Insurance Group · 4. Farmers Insurance Group · 5. Liberty Mutual · 6. 1. Allstate · 2. State Farm · 3. Farmers Insurance · 4. Liberty Mutual · 5. American National Insurance Company. home between years of age in Freeport, TX. Includes Wind TGS Insurance is proud to be one of Freeport's leading home insurance providers. The largest P&C insurers in the United States ; 10, Farmers Ins Group, 18,, ; 11, American Family Insurance Group, 16,, ; 12, Hartford Ins Group. Amica. The highest rated the best for customer service, Amica Insurance offers several benefits to their consumers. Not just covering home owners insurance. Insurance groups are made up of insurance companies that are related by ownership. This report provides cumulative market share data for the top 10 writers by. The highest rated the best for customer service, Amica Insurance offers several benefits to their consumers. Not just covering home owners insurance, Amica also. Top 10 Best Homeowners Insurance in Dallas, TX - August - Yelp - Royalty Insurance, Farmers Insurance - Kelly Harris, Lakewood Insurance. At PURE, insurance is about more than just the things we protect. Discover our range of insurance coverage solutions, perfect for high net worth. Top 10 Writers of Homeowners Insurance in Texas* · 1. State Farm · 2. Allstate Corp. · 3. USAA Insurance Group · 4. Farmers Insurance Group · 5. Liberty Mutual · 6. 1. Allstate · 2. State Farm · 3. Farmers Insurance · 4. Liberty Mutual · 5. American National Insurance Company. home between years of age in Freeport, TX. Includes Wind TGS Insurance is proud to be one of Freeport's leading home insurance providers. The largest P&C insurers in the United States ; 10, Farmers Ins Group, 18,, ; 11, American Family Insurance Group, 16,, ; 12, Hartford Ins Group. Amica. The highest rated the best for customer service, Amica Insurance offers several benefits to their consumers. Not just covering home owners insurance. Insurance groups are made up of insurance companies that are related by ownership. This report provides cumulative market share data for the top 10 writers by. The highest rated the best for customer service, Amica Insurance offers several benefits to their consumers. Not just covering home owners insurance, Amica also.

USAA Homeowners Insurance ranks among the top home insurers for its customer experience. Save up to 10% on your premiums when you bundle homeowners and auto. The largest P&C insurers in the United States ; 10, Farmers Ins Group, 18,, ; 11, American Family Insurance Group, 16,, ; 12, Hartford Ins Group. home between years of age in Freeport, TX. Includes Wind TGS Insurance is proud to be one of Freeport's leading home insurance providers. Look to Liberty Mutual for Texas homeowners insurance. We offer discounts for bundling your home/auto insurance policies. Click to get a free quote now. The Best Home Insurance in Texas for State Farm and Nationwide are among the best home insurance companies in Texas. Updated Mar 19, · 4 min read. The best home insurance companies include State Farm, Stillwater, American Family, Farmers, and Nationwide. It's about the best coverage. Sure, companies are filling up the airwaves promising you 5%, 10%, even 15% savings on your insurance premiums. Which sounds. The average cost of homeowners insurance in the Lone Star State is $4, per year for a policy with a $1, deductible and $, in dwelling coverage —. USAA Homeowners Insurance ranks among the top home insurers for its customer experience. Save up to 10% on your premiums when you bundle homeowners and auto. Compare Home Insurance Rates. Get the Best Quotes within Minutes. 10 Fast Quotes from Top-Rated Insurance Companies. Compare. , Chubb Lloyds Insurance Company of Texas, 10 ; , Nationwide Property and Casualty Insurance Company, 11 ; , ASI Lloyds, 12 ; , Travelers Home. For a dwelling value of at least $,, which 39% of Texas homeowners carry, Texas Farm Bureau ($1,/year), Chubb ($1,/year) and USAA ($2,/year) are. The Top 10 Questions To Ask About Homeowners Insurance. Ask these 10 questions to save money and get the best insurance coverage you can. Download The Top Ten. The Top 10 Questions To Ask About Homeowners Insurance. Ask these 10 questions to save money and get the best insurance coverage you can. Download The Top Ten. Several companies offer various insurance policies and types of coverage, including: Homeowners insurance; Renters insurance; Car insurance, including liability. Best Homeowners Insurance Agencies in Dallas ; Varon Insurance. Glenmont Drive, Houston, TX ; JBH Insurance Group. Commerce St. Ste, Dallas. Several companies offer various insurance policies and types of coverage, including: Homeowners insurance; Renters insurance; Car insurance, including liability. Benavides Insurance offers the best homeowners insurance in Brownsville, TX with comprehensive coverage at affordable rates tailored to your needs. The 5 best small business insurers in Texas for · Best Overall: Nationwide · Best for Hazard Insurance: The Hartford · Best for Contractor Coverage: State. The Average Rate for Homeowners Insurance in is $ per year | Compare Texas homeowners insurance rates by city, company and coverage level, learn how to save.

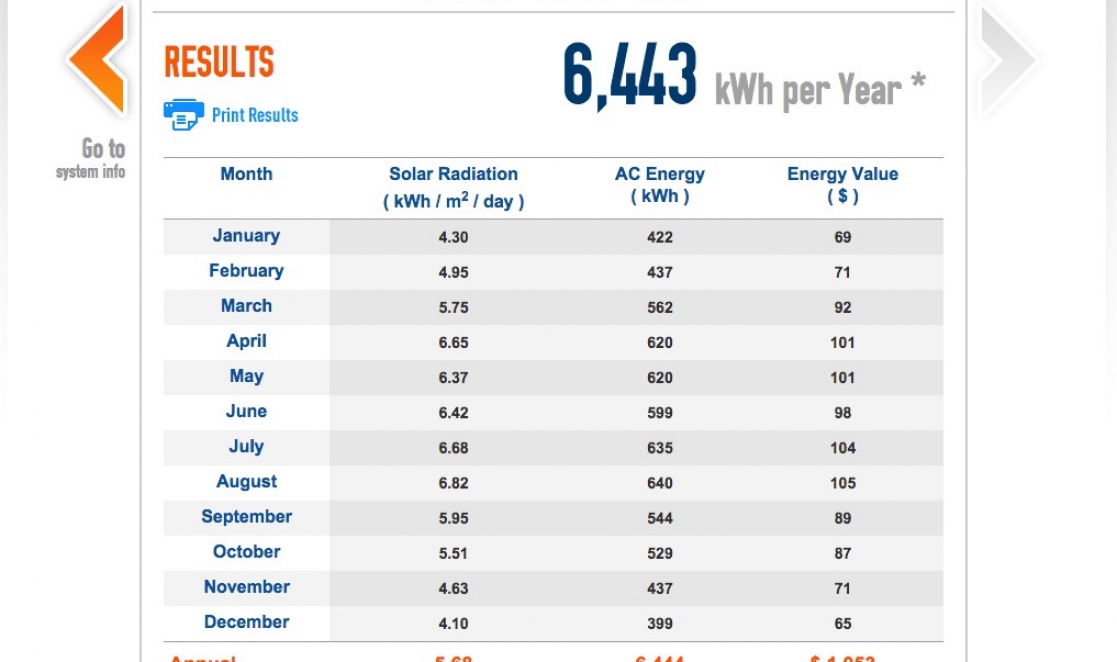

Solar Panel Loan Calculator

A solar loan calculator is a tool designed to help homeowners estimate the costs and financial benefits of installing a solar energy system using a loan. Get financing for installing your solar panels. Save up to 70% on your electricity bill. Calculate your savings now! Amortizing Loan Calculator. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly. Our Solar Power Plant on EMI program makes it easy and affordable for homeowners and businesses to invest in solar energy. With our EMI option. Learn all about solar loan re-amortization and how it can impact the financials of your solar panel installation Solar calculator · Solar rebates · News. WhatNextNow provides a FREE lease or buy solar panel calculator to help consumers decide between a solar lease, PPA, solar loan or a purchase. Learn about your solar financing options, the potential benefits and associated costs. See what your repayments will be by using our solar loan calculator. The average retail cost of power is expected to increase even at a higher rate in coming years. Solar Loan Payment Calculator. Solar loans come with fixed. Explore the cost of installing solar panels with the Solar Financing Calculator. Get an estimate for your monthly payments in no time! A solar loan calculator is a tool designed to help homeowners estimate the costs and financial benefits of installing a solar energy system using a loan. Get financing for installing your solar panels. Save up to 70% on your electricity bill. Calculate your savings now! Amortizing Loan Calculator. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly. Our Solar Power Plant on EMI program makes it easy and affordable for homeowners and businesses to invest in solar energy. With our EMI option. Learn all about solar loan re-amortization and how it can impact the financials of your solar panel installation Solar calculator · Solar rebates · News. WhatNextNow provides a FREE lease or buy solar panel calculator to help consumers decide between a solar lease, PPA, solar loan or a purchase. Learn about your solar financing options, the potential benefits and associated costs. See what your repayments will be by using our solar loan calculator. The average retail cost of power is expected to increase even at a higher rate in coming years. Solar Loan Payment Calculator. Solar loans come with fixed. Explore the cost of installing solar panels with the Solar Financing Calculator. Get an estimate for your monthly payments in no time!

Toronto Home Energy Loan · Ottawa Better Homes Loan · Investment Tax Solar Panel Calculator for Energy and Income. Ontario Solar Panels Calculator. You will pay a little extra in interest, but with fast paybacks on solar systems, it may allow you to get solar power. If you live in Victoria, you may also be. Embed the coding-free Solar Panel Loan Calculator template on your WordPress website and modify the features to streamline difficult calculations for users! Up to % Solar Panel Financing. % APR* - No Dealer Fees. APPLY NOW. To provide you with the best service and ease of install, we require all applicants. Use this solar loan calculator to determine the monthly payments and total interest you will pay toward a solar loan. This calculation represents an estimate. How to get a solar loan. 1 Make solar power a reality for your home with an affordable solar loan from RCU. Solar power is an environmentally friendly and affordable alternative to traditional electricity. A solar loan calculator can help you estimate the monthly. Results will be generated showing information such as the size of solar panel Greener Homes Loan. Interest-free financing to help make your home more. Solar panel efficiency decreases over time and this is referred to as degradation. Use this tool to compare the financial benefit of various financing options. Top solar panel loan providers in · Mosaic · Sunlight Financial · Goodleap · Dividend Financial · Energy Loan Network · Clean Energy Credit Union. You will get EMI as soon as you enter the required loan amount and the interest rate. Installment in EMI calculator is calculated on reducing balance. There are lots of solar financing options. Learn about solar financing, leasing, and loans and use our financing calculator to calculate cost. Our Solar Power Plant on EMI program makes it easy and affordable for homeowners and businesses to invest in solar energy. Solar Panel financing Calculator | Islamic Financing. Calculate your estimated Solar Financing Payments, interest and amount paid toward a solar loan with our Residential Solar Panel Loan Calculator. Financing · Reviews · Careers · Contact. Menu. Residential Solar. GSP Solar Go Solar Power highly recommends investing in a 10kW Solar Powered System. Looking for great reasons to go solar? Contact us today for a Greener tomorrow! Bill Calculator. Domestic. General. Rs. Solar Power 0KWp. Units Per Month. Ever wondered how much you could save by going solar? Find out if a SunPower home solar system is right for your home by using our residential solar power. Estimate financing options and costs for your solar panel installation. Calculate. Your Monthly Payment will be 0. Disclaimer: This calculator provides. What should I consider when getting solar panels?