escortbayan.online

Gainers & Losers

About Annuities

If an annuity owner is a Florida resident and the insurance company licensed to sell annuities in Florida becomes insolvent, a fixed deferred annuity will be. Life Annuity with Cash Refund or Installment Refund. Periodic payments are made for the Annuitant's lifetime and there is a guaranteed minimum total payment. A fixed annuity is a long-term retirement investment for people who want predictability. You'll receive a guaranteed rate of return on the premium you. Annuity contracts contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. Your licensed financial professional can provide. The reason for buying an immediate annuity is to obtain immediate income for retirement. If you are years away from retirement, consider a deferred annuity. How to feel financially secure in retirement. An income annuity may offer greater financial peace of mind. Annuities are a popular choice for those seeking certainty and predictable income streams in retirement; however, they can also be complex and confusing. Annuities · Fixed annuity contracts guarantee a minimum credited interest. · Variable annuity contracts allow the policy owner to allocate contributions into. As a senior, you have a right to a free day period to look over the annuity to make sure it is what you want. Within the day period you can return the. If an annuity owner is a Florida resident and the insurance company licensed to sell annuities in Florida becomes insolvent, a fixed deferred annuity will be. Life Annuity with Cash Refund or Installment Refund. Periodic payments are made for the Annuitant's lifetime and there is a guaranteed minimum total payment. A fixed annuity is a long-term retirement investment for people who want predictability. You'll receive a guaranteed rate of return on the premium you. Annuity contracts contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. Your licensed financial professional can provide. The reason for buying an immediate annuity is to obtain immediate income for retirement. If you are years away from retirement, consider a deferred annuity. How to feel financially secure in retirement. An income annuity may offer greater financial peace of mind. Annuities are a popular choice for those seeking certainty and predictable income streams in retirement; however, they can also be complex and confusing. Annuities · Fixed annuity contracts guarantee a minimum credited interest. · Variable annuity contracts allow the policy owner to allocate contributions into. As a senior, you have a right to a free day period to look over the annuity to make sure it is what you want. Within the day period you can return the.

Annuities are a common source of retirement income because they can provide a steady stream of payments at regular intervals and because their earnings grow tax. An annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future, such as after retirement. After a prolonged downturn, annuities are once again gaining popularity. To help you make the most informed decision for your personal financial situation. An annuity is the best way to be certain you will get payments for the rest of your life, no matter how long you live. Some people worry they will die early. An. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. You buy an. An annuity is a financial contract between an annuity purchaser and an insurance company. The purchaser pays either a lump sum or regular payments over a period. Simply put, an annuity plan that gives you a guaranteed1 amount throughout the tenure of the policy is a fixed annuity plan. This guaranteed amount is pre-. deferred income annuity (DIA) MassMutual offers registered index-linked annuities through our wholly owned subsidiary, MassMutual Ascend. These products. Associated Bank offers many annuity types. Some annuities offer tax-deferred growth. Contact our Customer Care Center for more information. Topics for Consumers within the Missouri Department of Commerce & Insurance. Saving for retirement? Choose from a Schwab variable annuity, fixed annuity, or income annuity for potential guaranteed lifetime income. In exchange for downside protection, indexed annuities limit your upside by capping your gains. At the same time, your return depends on how often the insurer. Annuity. An annuity is a contract you enter into with an insurance company to provide a guaranteed income in exchange for a payment or series of payments. Prudential Fixed Annuity with Daily Advantage Income Benefit®. Provides guaranteed daily growth of future income regardless of market performance. An income annuity is not an investment that provides you with a rate of return over a fixed period of time, like a CD.3 Rather, it's an income product that. It's good to keep in mind that if you make a withdrawal, any earnings in your contract will be taxable. You may also choose to receive income once you annuitize. Variable annuities are securities regulated by the SEC. An indexed annuity may or may not be a security; however, most indexed annuities are not registered with. An annuity is a contract between you and an insurance company under which you make either a lump sum payment or a series of payments, and in exchange, the. What is an annuity? · Premium. You pay a premium (think of it as your principal) to F&G. · Promise. In exchange for your premium, F&G provides an annuity. Myth: Annuities lock up my money. Truth: Annuities are designed as long-term savings vehicle. However, most annuities allow at least a certain percentage of.

What Is The Best S&P Index Fund

E-Mini S&P Futures · E-Mini Nasdaq Futures · E-Mini Dow Futures · E-Mini They help us learn which pages perform best, which ones need work, and how. Other ETFs that track the S&P include the iShares Core S&P ETF (IVV) and the Vanguard Index Fund (VOO). RELATED TOPICS. EquityAlternatives. The best S&P ETF by 1-year fund return as of 1, Amundi S&P II UCITS ETF EUR Dist, +%. 2, Amundi S&P II UCITS ETF Acc, +%. 3. IVE · iShares S&P Value ETF, Equity ; JEPI · JPMorgan Equity Premium Income Fund, Equity ; DGRO · iShares Core Dividend Growth ETF, Equity ; SPYV · SPDR. Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. S&P ETFs in comparison ; iShares Core S&P UCITS ETF USD (Dist)IE, 16, ; Vanguard S&P UCITS ETF (USD) AccumulatingIE00BFMXXD54, 12, Vanguard Index Fund Admiral Shares (VFIAX) - Find objective, share price, performance, expense ratio, holding, and risk details. As Knutson noted, index funds are very popular among investors because they offer a simple, no-fuss way to gain exposure to a broad, diversified portfolio at a. E-Mini S&P Futures · E-Mini Nasdaq Futures · E-Mini Dow Futures · E-Mini They help us learn which pages perform best, which ones need work, and how. Other ETFs that track the S&P include the iShares Core S&P ETF (IVV) and the Vanguard Index Fund (VOO). RELATED TOPICS. EquityAlternatives. The best S&P ETF by 1-year fund return as of 1, Amundi S&P II UCITS ETF EUR Dist, +%. 2, Amundi S&P II UCITS ETF Acc, +%. 3. IVE · iShares S&P Value ETF, Equity ; JEPI · JPMorgan Equity Premium Income Fund, Equity ; DGRO · iShares Core Dividend Growth ETF, Equity ; SPYV · SPDR. Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. S&P ETFs in comparison ; iShares Core S&P UCITS ETF USD (Dist)IE, 16, ; Vanguard S&P UCITS ETF (USD) AccumulatingIE00BFMXXD54, 12, Vanguard Index Fund Admiral Shares (VFIAX) - Find objective, share price, performance, expense ratio, holding, and risk details. As Knutson noted, index funds are very popular among investors because they offer a simple, no-fuss way to gain exposure to a broad, diversified portfolio at a.

SPLG is the cheapest S&P ETF I've seen at % expense ratio, which matches the SWPPX ER.

The investment seeks to track the total return of the S&P ® Index. The fund generally invests at least 80% of its net assets (including, for this purpose. Lipper Rankings: S&P Index Funds ; 1 Year. 67%. Rank 78 ; 3 Year. 64%. Rank 74 ; 5 Year. 64%. Rank 72 ; 10 Year. 61%. Rank According to S&P Global, “the S&P ® is widely regarded as the best single gauge of large-cap U.S. equities,” and according to Morningstar, the index covers. Open-end mutual funds and exchange-traded funds are considered a single population for comparison purposes. Ratings are calculated for funds with at least a. Invests in stocks in the S&P Index, representing of the largest U.S. companies. Goal is to closely track the index's return, which is considered a. Fidelity® Mega Cap Stock Fund · Fidelity® Large Cap Stock Fund · Fidelity® Growth & Income Portfolio · Fidelity® Dividend Growth Fund · Invesco S&P Index Fund. The numbers clearly show that the Nasdaq has significantly outperformed S&P index in terms of return over long term despite witnessing higher correction. Analyze the Fund Fidelity ® Index Fund having Symbol FXAIX for type mutual-funds and perform research on other mutual funds. Learn more about mutual. The Index is composed of 50 of the largest companies in the S&P ® Index. The Fund and the Index are rebalanced annually. Effective at the close of markets on. Fund Information · S&P Index · Jan 22 ; Fund Characteristics · % · ; Index Characteristics · % · ; Yields · % · - ; Fund Market Price. Fund Information · S&P Index · Jan 22 ; Fund Characteristics · % · ; Index Characteristics · % · ; Yields · % · - ; Fund Market Price. The S&P Top 10 Index consists of 10 of the largest companies from the S&P Index constituents are weighted by float-adjusted market capitalization. Find latest pricing, performance, portfolio and fund documents for Franklin S&P Index Fund - SBSPX Historical Morningstar Ratings. As of 07/31/ Years. The S&P ® Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and captures approximately. Best S&P ETFs to Invest in · SPY: The State Street SPDR S&P ETF was the original exchange-traded fund and remains one of the most liquid S&P ETFs. · VOO. Fund details, performance, holdings, distributions and related documents for Schwab S&P Index Fund (SWPPX) | Review the latest SWPPX fund details. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. Why IVV? 1. Exposure to the. Overall Morningstar Rating for iShares S&P Index Fund, as of Jul 31, rated against Large Blend Funds based on risk adjusted total return. Lipper. Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. The average year return of Nasdaq over these 15 years was around 9%, while that of S&P was about 5%. You could have earned a maximum year CAGR.

What Is Pmi Cost

Highlights: · Private mortgage insurance (PMI) is a supplemental insurance policy required for some mortgages with a down payment lower than 20%. · You'll. PMI costs vary from insurer to insurer, and from plan to plan. Example: A highly leveraged adjustable-rate mortgage requires the borrower to pay a higher. How much is PMI? On average, PMI costs range between % to % of your mortgage. How much you pay depends on two main factors: Lenders typically maintain. Monthly PMI. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each. Buyers with a 5% down payment can expect to pay a premium of approximately % times the annual loan amount, $ monthly for a $, purchase price. But. Private mortgage insurance (PMI) is insurance required by lenders when a borrower puts less than 20% down on a conventional loan. It's meant to protect the. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. How is PMI Calculated? · Down payment percentage (e.g., 5%, 10%, 15%) · Loan amount · Number of borrowers · Credit score · Property type · Debt-to-income ratio. Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount. Highlights: · Private mortgage insurance (PMI) is a supplemental insurance policy required for some mortgages with a down payment lower than 20%. · You'll. PMI costs vary from insurer to insurer, and from plan to plan. Example: A highly leveraged adjustable-rate mortgage requires the borrower to pay a higher. How much is PMI? On average, PMI costs range between % to % of your mortgage. How much you pay depends on two main factors: Lenders typically maintain. Monthly PMI. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each. Buyers with a 5% down payment can expect to pay a premium of approximately % times the annual loan amount, $ monthly for a $, purchase price. But. Private mortgage insurance (PMI) is insurance required by lenders when a borrower puts less than 20% down on a conventional loan. It's meant to protect the. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. How is PMI Calculated? · Down payment percentage (e.g., 5%, 10%, 15%) · Loan amount · Number of borrowers · Credit score · Property type · Debt-to-income ratio. Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount.

It is mandatory for all government-backed FHA and USDA loans, as well as most conventional loans where your down payment is less than 20%. The exact cost of PMI. Many lenders allow a 5%, 3% or even 0% down payment for a mortgage, so it's no wonder some buyers are choosing not to put down the traditional amount of 20%. your lender's stake), you can ask your lender to drop PMI. It will depend on your specific loan, but, generally, they are required by law to do so when you. Typically, Texas private mortgage insurance is usually required if you put less than 20% down payment for the home Call The most common type of PMI is borrower-paid mortgage insurance (BPMI), which is a monthly fee in addition to your mortgage payment. After your loan closes, you. This page contains information about the cost of private mortgage insurance (PMI). Private mortgage insurance (PMI) is a cost you pay when you take out a conventional mortgage and your down payment is less than 20%. Because the lender is. So, how much does PMI cost: it depends on a few different factors, but you can generally expect to pay a monthly premium of $30 to $70 for every $, that. Another important difference between MIP and PMI is the monthly mortgage insurance requirements. Every person who buys a house with an FHA loan must also pay. HSH offers a great PMI Calculator to calculate how much your mortgage insurance will cost you each month. See PMI costs for conforming and jumbo loans for. Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount. Typically, Texas private mortgage insurance is usually required if you put less than 20% down payment for the home Call If you are interested in refinancing or you think your home has increased in value, reach out to a PHH Loan Officer today to see if your PMI can be removed! Buyers with a 5% down payment can expect to pay a premium of approximately % times the annual loan amount, $ monthly for a $, purchase price. But. Most people pay PMI in monthly installments. However, it can also be paid in a single premium, upfront. According to mortgage insurer Genworth, a borrower with. Typical Range of PMI Rates. PMI rates typically range between % and 1% of the entire loan amount on an annual basis. For example, if your loan amount is. This page contains information about the cost of private mortgage insurance (PMI). PMI costs vary from insurer to insurer, and from plan to plan. Example: A highly leveraged adjustable-rate mortgage requires the borrower to pay a higher. As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78% scheduled date based on the original value. Private mortgage insurance premiums vary in amount, from a fraction of a percent to as much as % of the value of the original loan. PMI is paid each year.

Amazon Pay Debit Card

Amazon Payment Services supports three popular digital wallets: Apple Pay, Masterpass, and Visa Checkout. Amazon Business accepts credit and debit cards from Visa, Mastercard, American Express, and more. Business Prime American Express or Amazon Business American. The card opens in the center of the page. Select Edit under the card name. You can update your billing address, select a default card, update card details or. Chase Online Bill Pay: Must enroll in Chase Online℠ Banking and activate Online Bill Pay. Make purchases with your debit card, and bank from almost anywhere. A debit card just means, it's tied directly to your bank account. Any internet based transaction will use your debit card like a credit card. Technically you. Earn 3% cashback on your spends on Amazon India even if you are not a member of Amazon Prime. Use this card on Amazon Pay and earn 2% cashback on payments to. Credit Cards: Visa, Mastercard, American Express, Diners Club, and RuPay; Debit Cards: Visa, Mastercard, RuPay, and Maestro. We accept all international cards. Is my payment information shared with anyone? We don't share your full credit card, debit card, or bank account number with merchants or charitable. Replace or add a credit or debit card · Sign in to Seller Central with your Amazon Payments merchant account. · Click the Settings icon, and then click Account. Amazon Payment Services supports three popular digital wallets: Apple Pay, Masterpass, and Visa Checkout. Amazon Business accepts credit and debit cards from Visa, Mastercard, American Express, and more. Business Prime American Express or Amazon Business American. The card opens in the center of the page. Select Edit under the card name. You can update your billing address, select a default card, update card details or. Chase Online Bill Pay: Must enroll in Chase Online℠ Banking and activate Online Bill Pay. Make purchases with your debit card, and bank from almost anywhere. A debit card just means, it's tied directly to your bank account. Any internet based transaction will use your debit card like a credit card. Technically you. Earn 3% cashback on your spends on Amazon India even if you are not a member of Amazon Prime. Use this card on Amazon Pay and earn 2% cashback on payments to. Credit Cards: Visa, Mastercard, American Express, Diners Club, and RuPay; Debit Cards: Visa, Mastercard, RuPay, and Maestro. We accept all international cards. Is my payment information shared with anyone? We don't share your full credit card, debit card, or bank account number with merchants or charitable. Replace or add a credit or debit card · Sign in to Seller Central with your Amazon Payments merchant account. · Click the Settings icon, and then click Account.

Payment Methods · Payment Plans (Buy Now, Pay Over Time) · Amazon Credit Cards · Shop with Points · Amazon Currency Converter. The Amazon Flex Debit Card2 is offered exclusively to delivery partners, in partnership with Green Dot Bank, Member FDIC. It offers cash back1, no monthly. It's generally safe to use a debit card on Amazon, but still bad practice. IF there is fraud, it's your money tied up until an investigation is. PayPal debit cards are now accepted on Amazon, allowing personal and business account holders to make purchases. Apply or request a card to use this. You can edit bank account, credit and debit card information on the Amazon website at any time. Edit your payment method information. Amazon Pay allows you to shop easily and securely on the Internet. Once you've entered in your data, you're guaranteed a speedy shopping experience, as you will. The Amazon Flex Debit Card is the easiest way to manage your money from anywhere, anytime. Access these features and more • No monthly fee. Sold by Amazon Payments, Inc. $ Mastercard Gift Card (plus $ Purchase Fee) · out of 5 stars. Amazon Pay is a service that lets you use the payment methods already associated with your Amazon account to make payments for goods or services on third-party. You can delete any credit card, debit card or bank account that you have previously registered with Amazon Payments. To make a payment, you can use a credit card, debit card, bank account, or Amazon Payments Account balance. How do I sign up? You will be prompted. Amazon will allow you to add a debit card on the same page where you add credit cards, your checking account, or other payment methods. Amazon Pay is a payment option that enables merchants to streamline the checkout process, increase conversion rates, and build trust with customers. In Your Account, select Payment options. · Do one of the following: To add a payment method, select Add a credit or debit card listed under Add a New Payment. Online shopping from a great selection at Credit & Payment Cards Store. Make a payment by phone: Call Synchrony Bank at A payment made through the automated phone system or with a Customer Service representative is. Amazon accepts debit cards both directly and indirectly. Amazon Pay is a wallet payment method that lets your customers check out the same way as on escortbayan.online When customers select Amazon Pay as their payment. Amazon Pay accepts credit and debit cards. You can learn more about accepted payment methods here. 1See here for terms and conditions for Grubhub. The Amazon Flex Debit Card is the easiest way to manage your money from anywhere, anytime. Access these features and more • No monthly fee • Lock your card.

How To Invest In Income Property

Becoming the person that they rent from can be a great way to generate some income for yourself and pay down the mortgages you use to acquire property. Here are six investment property strategy tips that could help you make the most of potential profits and minimise risks. 1. Rental Properties · 2. Real Estate Investment Groups (REIGs) · 3. House Flipping · 4. Real Estate Investment Trusts (REITs) · 5. Online Real Estate Platforms. It could be a variety of factors, but it mostly pertains to how lenders value each investment type. Multifamily properties are valued on the rents coming in and. Find commercial real estate services and property investment strategies. We work with owners, tenants and investors in the local, national and global. Property investment is often seen as being less risky than other forms of investment. However, while it may seem more straightforward, there are pitfalls to be. We will discuss the basics of investing in rental properties, including an overview of how to find a viable rental property and obtain financing for it. 1. Secure your financing. Unless you have a lot of cash sitting around, you need to line up financing for your rental property acquisition. It can provide an additional stream of income. · Investing in real estate can help diversify your investment portfolio. · Real estate investments may reduce your. Becoming the person that they rent from can be a great way to generate some income for yourself and pay down the mortgages you use to acquire property. Here are six investment property strategy tips that could help you make the most of potential profits and minimise risks. 1. Rental Properties · 2. Real Estate Investment Groups (REIGs) · 3. House Flipping · 4. Real Estate Investment Trusts (REITs) · 5. Online Real Estate Platforms. It could be a variety of factors, but it mostly pertains to how lenders value each investment type. Multifamily properties are valued on the rents coming in and. Find commercial real estate services and property investment strategies. We work with owners, tenants and investors in the local, national and global. Property investment is often seen as being less risky than other forms of investment. However, while it may seem more straightforward, there are pitfalls to be. We will discuss the basics of investing in rental properties, including an overview of how to find a viable rental property and obtain financing for it. 1. Secure your financing. Unless you have a lot of cash sitting around, you need to line up financing for your rental property acquisition. It can provide an additional stream of income. · Investing in real estate can help diversify your investment portfolio. · Real estate investments may reduce your.

At the beginning of your investment, rental income may help cover your mortgage payments. Depending on the market, it could potentially cover your monthly. If you don't want to put up with the headache of managing a rental property or can't come up with the down payment, real estate investment trusts (REITs) are an. How to invest in property: 9 tips for taking your first step onto the property ladder · 1. Location, location, etc · 2. Get your financial situation in order · 3. Buying an Investment Rental Property in Ontario is challenging, but can be incredibly rewarding. Proper management of assets have the potential to yield returns. 1. Rental Properties · 2. Real Estate Investment Groups (REIGs) · 3. House Flipping · 4. Real Estate Investment Trusts (REITs) · 5. Online Real Estate Platforms. Real estate investments can also be used to pass on generational wealth. Investing in real estate with a Roth IRA can even allow you to pass on your investment. Buy a property, lease it, collect cheques and plan your retirement. But before purchasing an income property, you should be aware of the benefits and drawbacks. This article will discuss how to correctly value and analyze an investment property for maximum potential profits. Research the pros and cons before making any decision and be clear on what your goals and risk appetite for owning rental property are. Here's how you can invest in rental properties without the responsibility of being a landlord · Real estate investing for seasoned pros and newbies alike. Getting a mortgage for an investment property isn't as easy as borrowing for your primary residence. You'll need at least 20% of the purchase price for a down. We've got what you need to know when it comes to buying a first-time investment property in Ontario. Here are six investment property strategy tips that could help you make the most of potential profits and minimise risks. It could be a variety of factors, but it mostly pertains to how lenders value each investment type. Multifamily properties are valued on the rents coming in and. Access high-yield alternative investment opportunities in real estate, private credit, private equity, hedge funds, and venture capital at BuyProperly. Above you will find all residential investment opportunities active on the Boise MLS. Including Single-Family Income, Duplex and Fourplex Properties. Real estate investing involves the purchase, management and sale or rental of real estate for profit. Someone who actively or passively invests in real. Analytically speaking, there are several valuation methods investors use to determine whether or not a rental property is worth it. We are trying to buy an investment house or townhouse ~K or less with 20% down payment in Seattle area.

How Much Does The S&P 500 Cost

S&P 1 Year Return is at %, compared to % last month and % last year. This is higher than the long term average of %. The S&P 1. A lot of people will want to argue with me on that rate of return. But here's the truth: Historically, the year average return of the S&P S&P Index ; Open 5, ; Day Range 5, - 5, ; 52 Week Range 4, - 5, ; 5 Day. % ; 1 Month. %. The Vanguard Index Fund (VFINX) has a % fee and a $3, minimum. And here are the fees in the world of ETFs: The Vanguard S&P ETF (VOO) costs %. The most famous index is the Dow Jones Industrial Average, a price-weighted index of 30 stocks created in The S&P is far more diversified than the. the S&P , it would be companies. They represent about 70% of Tax cost ratio is a Morningstar measure of how much an investor in the highest. How Much Does It Cost to Invest in the S&P ? The difference in fees between S&P index funds and ETFs these days is marginal. For example, some of the. Average taxable gain passed on to shareholders when an investment within an ETF or mutual fund is sold for more than its original price. Expand Collapse. I know how the current value of the S&P (~$4,),. That's does mean what you think it means. It's not a dollar amount, it's just an index. S&P 1 Year Return is at %, compared to % last month and % last year. This is higher than the long term average of %. The S&P 1. A lot of people will want to argue with me on that rate of return. But here's the truth: Historically, the year average return of the S&P S&P Index ; Open 5, ; Day Range 5, - 5, ; 52 Week Range 4, - 5, ; 5 Day. % ; 1 Month. %. The Vanguard Index Fund (VFINX) has a % fee and a $3, minimum. And here are the fees in the world of ETFs: The Vanguard S&P ETF (VOO) costs %. The most famous index is the Dow Jones Industrial Average, a price-weighted index of 30 stocks created in The S&P is far more diversified than the. the S&P , it would be companies. They represent about 70% of Tax cost ratio is a Morningstar measure of how much an investor in the highest. How Much Does It Cost to Invest in the S&P ? The difference in fees between S&P index funds and ETFs these days is marginal. For example, some of the. Average taxable gain passed on to shareholders when an investment within an ETF or mutual fund is sold for more than its original price. Expand Collapse. I know how the current value of the S&P (~$4,),. That's does mean what you think it means. It's not a dollar amount, it's just an index.

This fund does not seek to follow a sustainable, impact or ESG investment strategy. value (the “valuation price”). Holdings data shown reflects the investment. S&P (SPX) ; Prev. Close: 5, ; Open: 5, ; 1-Year Change: ; Volume: 0 ; Average Vol. (3m): 2,,, costs, expenses and other factors. Fund shares are not individually If the Fund does not incur any fee waivers and/or expense reimbursements. Firms commonly describe their financial performance in terms of how they did relative to the Index, and the SEC requires S&P constituent firms to disclose. View the full S&P Index (SPX) index overview including the latest stock market news, data and trading information. This fund does not seek to follow a sustainable, impact or ESG investment strategy. value (the “valuation price”). Holdings data shown reflects the investment. $10, invested in the S&P at the beginning of would have grown to $32, over 20 years — an average return of % per year. Missing the 'top. Since this is a price index and not a total return index, the S&P index here does not contain dividends. Copyright © , S&P Dow Jones Indices LLC. Considering the last four recessions, the S&P tended to perform better on average in terms of price return, both during and 12 months after the start of the. The portfolio of iShares S&P Index XUS, which follows the S&P , has an average market cap of $ billion. As a bonus, these index funds often charge. Vanguard average ETF expense ratio: %. Industry average ETF expense ratio: %. All averages are asset-weighted. Industry average excludes Vanguard. ^DJI Dow Jones Industrial Average. 40, +%. ^IXIC NASDAQ Composite. 16, +%. ^NYA NYSE COMPOSITE (DJ). 18, +%. ^XAX NYSE AMEX. $10, invested in the S&P at the beginning of would have grown to $32, over 20 years — an average return of % per year. Missing the 'top. The total expense ratio (TER) of S&P ETFs is between % p.a. and % p.a.. In comparison, most actively managed funds do cost much more fees per year. rate of return. Since , the average annual total return for the S&P , an unmanaged index of large U.S. stocks, has been about 10%. Investments that. Price to Book Ratio Price to Sales Ratio 1 Year Return Popular Securities. Dow Jones Industrial Average. 40,USD. +%. S&P INDEX. The S&P ® Value measures constituents from the S&P that are classified as value stocks based on three factors: the ratios of book value, earnings and. S&P (SPX) ; Prev. Close: 5, ; Open: 5, ; 1-Year Change: ; Volume: 0 ; Average Vol. (3m): 2,,, While you should not base any investment decision entirely on expenses or S&P Index$33, MORNINGSTAR CATEGORY AVERAGE. Large Blend$27, The total expense ratio (TER) of S&P ETFs is between % p.a. and % p.a.. In comparison, most actively managed funds do cost much more fees per year.

Nipsco Stock

NiSource offers a Dividend Reinvestment and Stock Purchase Plan that allows registered common stockholders to reinvest dividends. View NiSource, Inc NI investment & stock information. Get the latest NiSource, Inc NI detailed stock quotes, stock data, Real-Time ECN, charts. NYSE: NI ; Day High$ ; Day Low$ ; Volume2,, ; Market CapB ; Today's Open$ Get the latest NiSource Inc (NI) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. The Board of Directors of NiSource Inc. (NYSE: NI) today declared a quarterly common stock dividend payment of 21 cents per share, payable Novem. Welcome to our dedicated page for NiSource news (Ticker: $NI), a resource for investors and traders seeking the latest updates and insights on NiSource stock. Discover historical prices for NI stock on Yahoo Finance. View daily, weekly or monthly format back to when NiSource Inc. stock was issued. NiSource Inc., an energy holding company, operates as a regulated natural gas and electric utility company in the United States. NiSource Inc. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. NiSource offers a Dividend Reinvestment and Stock Purchase Plan that allows registered common stockholders to reinvest dividends. View NiSource, Inc NI investment & stock information. Get the latest NiSource, Inc NI detailed stock quotes, stock data, Real-Time ECN, charts. NYSE: NI ; Day High$ ; Day Low$ ; Volume2,, ; Market CapB ; Today's Open$ Get the latest NiSource Inc (NI) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. The Board of Directors of NiSource Inc. (NYSE: NI) today declared a quarterly common stock dividend payment of 21 cents per share, payable Novem. Welcome to our dedicated page for NiSource news (Ticker: $NI), a resource for investors and traders seeking the latest updates and insights on NiSource stock. Discover historical prices for NI stock on Yahoo Finance. View daily, weekly or monthly format back to when NiSource Inc. stock was issued. NiSource Inc., an energy holding company, operates as a regulated natural gas and electric utility company in the United States. NiSource Inc. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %.

Research NiSource's (NYSE:NI) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Based on 6 Wall Street analysts offering 12 month price targets for Nisource in the last 3 months. The average price target is $ with a high forecast of. View live NiSource Inc chart to track its stock's price action. Find market predictions, NI financials and market news. Profile. NiSource Inc. is an energy holding company and together with its subsidiaries provides natural gas, electricity and other products and services in the. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change NiSource stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. See the latest NiSource Inc stock price (NI:XNYS), related news, valuation, dividends and more to help you make your investing decisions. NiSource Inc. is an energy holding company. The Company operates through two segments: Gas Distribution Operations and Electric Operations. Over the last year, NiSource Inc.'s stock price has increased by %. NiSource Inc. is currently approximately $ per share. The 16 analysts offering price forecasts for Nisource have a median target of , with a high estimate of and a low estimate of The NiSource week low stock price is , which is % below the current share price. The average NiSource stock price for the last 52 weeks is Stock analysis for NiSource Inc (NI:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Is NiSource Inc stock A Buy? NiSource Inc holds several positive signals and is within a strong rising trend. As the old saying says, "Let the trend be your. View NiSource Inc NI stock quote prices, financial information, real-time forecasts, and company news from CNN. NiSource isn't a household name among investors, but the low-risk utility stock -- and its % dividend -- deserves a little more attention. NiSource Inc. Announces Decision to Postpone the Remarketing of its Series C Mandatory Convertible Preferred Stock Due to Market Conditions · NiSource declares. NiSource, Inc. (escortbayan.online): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock NiSource, Inc. | Nyse: NI | Nyse. Find the latest historical data for NiSource Inc Common Stock (NI) at escortbayan.online View historical data in a monthly, bi-annual, or yearly format. NiSource Inc News & Analysis · Ni Source Inc stock soars to all-time high of $ amid robust growth · NiSource announces quarterly dividend of $ per.

Sole Trader Accounts

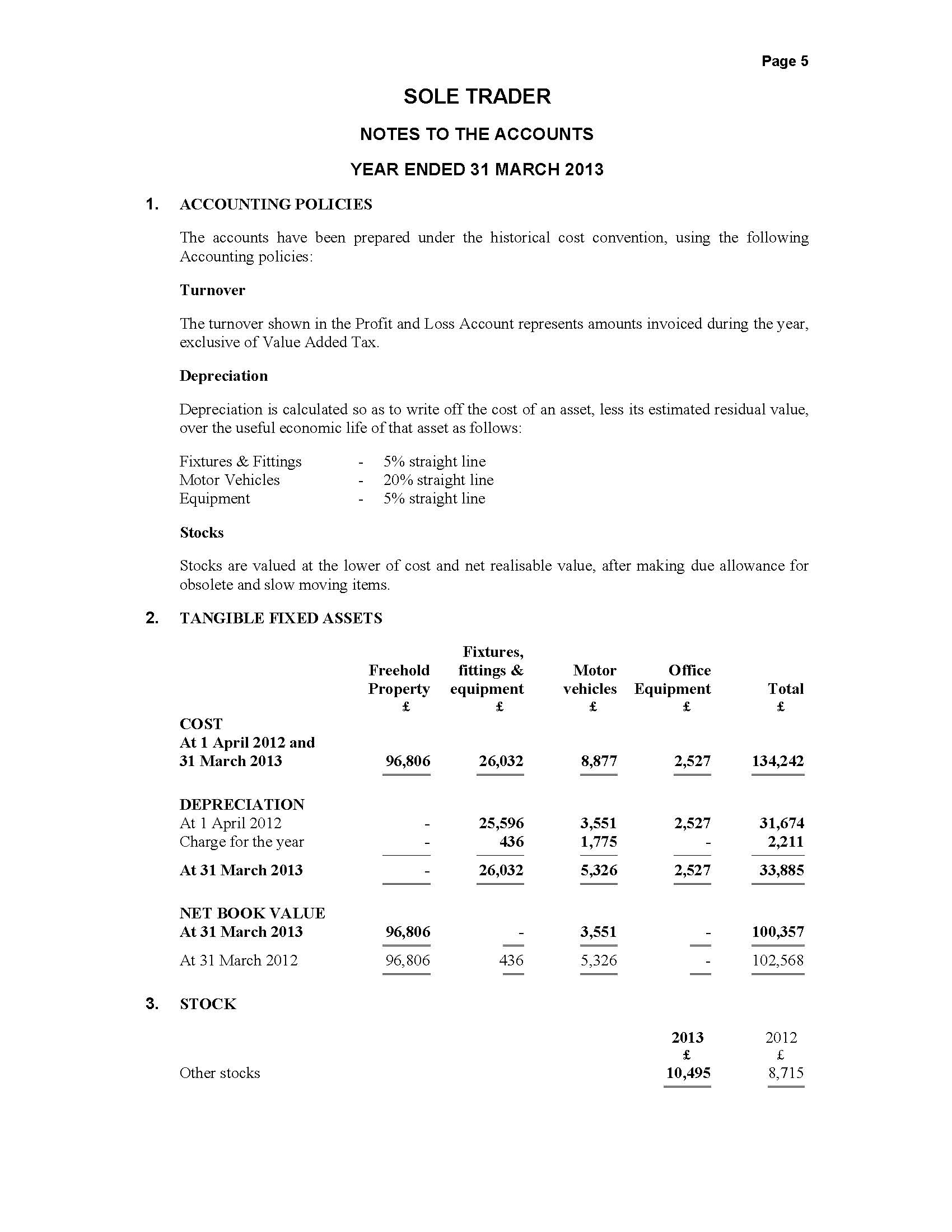

Is there any legal reason to have a business bank account? If you were very diligent in separating and organising only from a personal bank account. You are not required to have an accountant for your business accounts if you can do your own bookkeeping and tax return. But if you are unsure how much tax you. What responsibilities do I have as a sole trader? · Keeping records of your business's sales and expenses · Sending a Self Assessment tax return every year. Get to Grips with Your Sole Trader Accounts and Tax Return [Outram, Jo] on escortbayan.online *FREE* shipping on qualifying offers. Get to Grips with Your Sole. The main benefit of having a business account as a sole trader is clarity. Your business accounting and cash flow will be much more straightforward, which makes. It is not a legal requirement for self-employed sole traders to publish formal accounts. However, there are often benefits to producing formal. Thornton & Associates recommends accountedfor as the best accounting system for Sole Traders to manage their tax and keep their business running smoothly. You're a sole trader for tax purposes if you are the only person involved in your business and you have complete responsibility for all aspects of it. A sole proprietorship is an unincorporated business with one owner. There is no legal separation between the company and the owner. Is there any legal reason to have a business bank account? If you were very diligent in separating and organising only from a personal bank account. You are not required to have an accountant for your business accounts if you can do your own bookkeeping and tax return. But if you are unsure how much tax you. What responsibilities do I have as a sole trader? · Keeping records of your business's sales and expenses · Sending a Self Assessment tax return every year. Get to Grips with Your Sole Trader Accounts and Tax Return [Outram, Jo] on escortbayan.online *FREE* shipping on qualifying offers. Get to Grips with Your Sole. The main benefit of having a business account as a sole trader is clarity. Your business accounting and cash flow will be much more straightforward, which makes. It is not a legal requirement for self-employed sole traders to publish formal accounts. However, there are often benefits to producing formal. Thornton & Associates recommends accountedfor as the best accounting system for Sole Traders to manage their tax and keep their business running smoothly. You're a sole trader for tax purposes if you are the only person involved in your business and you have complete responsibility for all aspects of it. A sole proprietorship is an unincorporated business with one owner. There is no legal separation between the company and the owner.

Streamline your Monthly Sole Trader Accounts process with this workflow template. Sole traders do not have to file accounts with a public body (like Companies House for limited companies). However, they should prepare a balance sheet and. Straight forward, hassle-free online accounting services designed exclusively for sole traders. Whether you have a part-time, growing or established sole. At the top is the trading account, which is the part that determines gross profit for the period. This is followed by the remaining part of the income. A sole trader can take on the accounting function of their business, but many do not have the time or appetite to do so. Hiring an accountant can, therefore. Become a sole trader with HM Revenue and Customs - your legal responsibilities if you run a business as a self-employed sole trader. PROFESSIONAL CHARGES Preparing your draft and final accounts for the year so that you can see how your business is progressing. Learn how to produce accounts for your sole trader clients in Xero Tax. Features of self-employed accounting software for sole traders · Say goodbye to piles of paper · Connect your bank account · Sort your transactions · Self. Gorilla Accounting are the Sole Trader accounting experts. We bust the jargon by offering a comprehensive, real-time, hassle-free accounting solution. With no monthly fees and 24/7 support, Starling's award-winning sole trader bank account saves you time and money while you run the show. Apply now. Important Accounting Deadlines For Companies And Sole Traders. Keep this guide handy as an overview of your deadlines and follow our tips to help you meet them. With Tide, you can open a free business bank account and start using it straight away. We have all the business tools you need to progress as a sole trader and. Yes, you can do your own accounts as a sole trader – a sole trader's accounts can be relatively simple in some cases and do not need to be audited or filed with. escortbayan.online: Sole Trader Accounts Book: Self Employed Bookkeeping Ledger For Small Business Accounting: Journals, Johnsons: Books. QuickBooks' sole trader accounting software is the easiest way for sole traders and freelancers to manage their finances. Start a free trial today. A sole trader is the most simple and minimalistic form of business structure which is relatively inexpensive and easy to set up. If a single proprietor engages. Our sole trader accounting services start from only £34+VAT per month and include taking care of sole trader accounts, tax and bookkeeping. As a sole trader, you pay yourself based on personal drawings from the business, and you pay Income Tax and National Insurance Contributions based on the. Sole Trader Accounting Services. Whether you require ongoing bookkeeping to submit your accounts at the end of the year, or a simple self-assessment tax return.

When Should You Buy Stocks

What is a stock? Common stocks are long-term investments that can help grow your money. – Stock splits have no tangible impact on a company's total value—they simply create more shares at more affordable prices. Nor does a split change the total. Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Book overview. A new edition of a classic stock market guide offers clear explanations and reasonable and understandable advice on investments, updating. Several studies have shown that it's not so bad to invest at the high point each year (as if you could be so unlucky to invest at the market high every year). Capital growth. The price of a stock will go up or down over time. When it goes up, shareholders can choose to sell their shares at a profit. The general trader consensus on the best time to sell a US stock is probably just before the last hour of the NYSE's trading session from 3 pm to 4 pm EST. This may come as no surprise for you, but there's no right or wrong time to buy shares. In fact, it's not so much about when you buy stocks and shares, but. When's the best time to buy stocks? It's like trying to time the perfect wave to surf. You want to catch it at the right moment, but it's not always possible. What is a stock? Common stocks are long-term investments that can help grow your money. – Stock splits have no tangible impact on a company's total value—they simply create more shares at more affordable prices. Nor does a split change the total. Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Book overview. A new edition of a classic stock market guide offers clear explanations and reasonable and understandable advice on investments, updating. Several studies have shown that it's not so bad to invest at the high point each year (as if you could be so unlucky to invest at the market high every year). Capital growth. The price of a stock will go up or down over time. When it goes up, shareholders can choose to sell their shares at a profit. The general trader consensus on the best time to sell a US stock is probably just before the last hour of the NYSE's trading session from 3 pm to 4 pm EST. This may come as no surprise for you, but there's no right or wrong time to buy shares. In fact, it's not so much about when you buy stocks and shares, but. When's the best time to buy stocks? It's like trying to time the perfect wave to surf. You want to catch it at the right moment, but it's not always possible.

How they work. When you buy a share of stock, you're entitled to a small fraction of the assets of that company — even dividends. Traders often compare a stock to its sector and see how it's doing compared to other stocks. Case in point: the P/E ratio. If your stock has the highest P/E, it. All investments involve some degree of risk. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand. All investments involve some degree of risk. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand. There are several factors to consider when deciding whether to hold or sell an investment position, including your risk tolerance and time horizon. Equities can add diversification and serve as a growth engine to help build value over time: Higher growth potential — Equities serve as a cornerstone for many. If you are a value investor buying when price You buy when this situation arise rather than based on some calendar time. Stocks offer investors the greatest potential for growth (capital appreciation) over the long haul. Investors willing to stick with stocks over long periods of. Trading volume tends to cluster around the morning and evening, but institutional investors, especially, trade later in the day. For instance, some money. We guide you through the steps to buying stocks. Whether you're a novice investor or seeking to refine your strategy, this comprehensive guide is tailored for. Potential Benefits Of Investing In Stocks · Potential capital gains from owning a stock that grows in value over time · Potential income from dividends paid by. While everyone's financial situation is different, there are a few telltale signs that someone is not ready to start investing. Traders often compare a stock to its sector and see how it's doing compared to other stocks. Case in point: the P/E ratio. If your stock has the highest P/E, it. With all these factors taken into consideration, the best time of day to trade is to am. The stock market opens for trading at AM and in the. How they work. When you buy a share of stock, you're entitled to a small fraction of the assets of that company — even dividends. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to. Once you've reached that point, consider selling it and enjoying the gains. Another good time to sell a stock is when you reach a personal savings goal. 'Buy. Thinking about buying the dip? When talking about stocks or any financial asset, a dip is a drop in price. You might buy the dip if you think the price will. We guide you through the steps to buying stocks. Whether you're a novice investor or seeking to refine your strategy, this comprehensive guide is tailored for. Since stocks trade by the millions every day, you can move quickly when you're buying or selling. Control. You decide which company to invest in, when it's time.

Save Down Payment House

Pay less for your loan: A larger down payment reduces your mortgage insurance and may qualify you for a lower interest rate, which saves you money in the long. 1. Know how much house you can afford. This is a smart first step that will help you compute how much your down payment for a house should be. Use gift funds. Whether your parents gifted you cash, or you got married, or you started a GoFundMe account to save money for your starter home, many lenders. Yes, having a bigger down payment can help you get approved for a mortgage with a lower APR and avoid paying Private Mortgage Insurance (PMI), but you don't. How to save for a house down payment · 1. Figure out how much house you can afford · 2. Set a down payment percentage · 3. Determine how long you have to save. 9 Ways to Save for a House · 1. Place your savings somewhere that allows you to earn more money · 2. Automate your savings · 3. Reduce current expenses wherever. Use gift funds. Whether your parents gifted you cash, or you got married, or you started a GoFundMe account to save money for your starter home, many lenders. You're probably planning on taking out a loan and paying a mortgage for your new home. But you'll still need to cover the cost of a down payment, which comes. Most financial planners advise buyers to make a down payment of at least 20 percent to save on fees and private mortgage insurance. Pay less for your loan: A larger down payment reduces your mortgage insurance and may qualify you for a lower interest rate, which saves you money in the long. 1. Know how much house you can afford. This is a smart first step that will help you compute how much your down payment for a house should be. Use gift funds. Whether your parents gifted you cash, or you got married, or you started a GoFundMe account to save money for your starter home, many lenders. Yes, having a bigger down payment can help you get approved for a mortgage with a lower APR and avoid paying Private Mortgage Insurance (PMI), but you don't. How to save for a house down payment · 1. Figure out how much house you can afford · 2. Set a down payment percentage · 3. Determine how long you have to save. 9 Ways to Save for a House · 1. Place your savings somewhere that allows you to earn more money · 2. Automate your savings · 3. Reduce current expenses wherever. Use gift funds. Whether your parents gifted you cash, or you got married, or you started a GoFundMe account to save money for your starter home, many lenders. You're probably planning on taking out a loan and paying a mortgage for your new home. But you'll still need to cover the cost of a down payment, which comes. Most financial planners advise buyers to make a down payment of at least 20 percent to save on fees and private mortgage insurance.

By putting at least 20% down, you will avoid Private Mortgage Insurance (PMI). Even if you can't get to 20%, try to save as large of a down payment as you. You're probably planning on taking out a loan and paying a mortgage for your new home. But you'll still need to cover the cost of a down payment, which comes. Paying 20% down can benefit a homebuyer in multiple ways, such as reducing the mortgage loan's interest rate, lowering the cost of monthly mortgage payments and. Saving for your home purchase ensures you have enough money for your down payment and closing costs. Read this guide for tips on how to reach this goal. 9 Ways to save for a down payment. 1. Trim expenses out of your budget. Most people are surprised when they start totaling up their everyday expenses. The Homebuyers' Plan lets you withdraw up to $35, ($70, per couple) from your R R S P to help you purchase your first home. It's a great way to access. Boost your down payment. If you can pay 20% of your home's price, you'll get a better interest rate and eliminate PMI, which bumps up your monthly payment. If. The answer to how to save money for a house isn't mostly about grueling sacrifice—eg, holing up in your apartment under a bare light bulb, eating ramen, and. 54% of first-time homebuyers save for a down payment. For first-time buyers, it usually ranges from 6% to 7% of the total house price. For one thing, you'll likely avoid having to buy mortgage insurance. A 20% down payment also makes you more protected against property price declines, giving. Research your loan options, sock away some of your income, and look into down payment programs to limit your out-of-pocket expenses. The amount of your down payment is determined, in part, on the loan type you choose. For FHA loans, a down payment of % is required for maximum financing. So. By paying down debt you can gain some wiggle room in your monthly budget. The money you used to pay bills can now go directly into your savings account rather. Start by paying off credit card debt and other debts. Set a realistic budget, cut unneeded expenses and start saving extra money for your down payment. Saving for a down payment on a home? Create a savings plan, streamline your spending, and get creative tips to boost your income with our free guide. By putting at least 20% down, you will avoid Private Mortgage Insurance (PMI). Even if you can't get to 20%, try to save as large of a down payment as you. Most real-estate experts will tell you to have at least 5% of the cost of a house on hand in savings to account for the down payment. This calculator will help you create a savings plan towards your home purchase down payment. Simply use your purchase price to calculate how much you need to. The answer to how to save money for a house isn't mostly about grueling sacrifice—eg, holing up in your apartment under a bare light bulb, eating ramen, and. You should have at least 30% of the value of the home saved in cash. 20% is for the downpayment to avoid PMI insurance, and the other % is for a healthy.